Fees - nothing to hide

Small fees make a big difference

Many people make the mistake of thinking a small fee difference of 1% can’t make a big impact on their final returns. But due to the magic of compounding which Albert Einstein described as one of the most powerful forces in the universe, the negative impact tends to be much bigger than anticipated.

With investments, compounding occurs when the money you put away grows, and that increased profit is reinvested to earn more. The same can happen with fees. If you pay high fees, year after year, the end total can eat up a huge portion of your investment pot.

Get total transparency

Gina Miller has been spearheading the fight for 100% fee and holdings transparency, and has been vocal about improving ethics and responsibility in the UK financial services industry since 2009.

Due to her tireless campaigning with the UK Treasury, governments, global industry bodies and national regulators, new rule and regulations were brough into force in 2014 that have vastly improved investment and pension consumers rights and protections. But there is still more to do as some providers are still being economic with the truth about their fees and charges.

At MoneyShe, we publish ALL our costs and fee charges in one Total Cost of Investing figure, which is updated monthly on every Portfolio Factsheet.

Our performance data is also after ALL costs and charges. 100% transparent, nothing hidden.

Our fees are 100% transparent, nothing hidden

0.40%

per annum MoneyShe/SCM Direct annual management fee

0.12%

per annum administration & custody Fee

0.15%

per annum typical underlying ETF charges

0.12%

per annum estimated trading costs of buying and selling ETFs

0.06%

per annum estimated transaction costs within the ETFs

0.85%

per annum

Total Cost of Investing

No performance fees, no adviser charges, no initial charges and no exit penalties.

Fees will vary according to the current selection of ETFs and current levels of trading activity, latest fees shown in all monthly factsheets. When investing via the Hubwise SIPP, an additional charge is made of 0.1%+VAT subject to a minimum annual charge of £15+VAT and a maximum annual charge of £50+VAT. An additional fee of £125 +VAT applies to any SIPP that is in drawdown. Other fees for work in relation to for commercial property, divorce & death for example are available on request and will be quoted to you before any work is carried out.

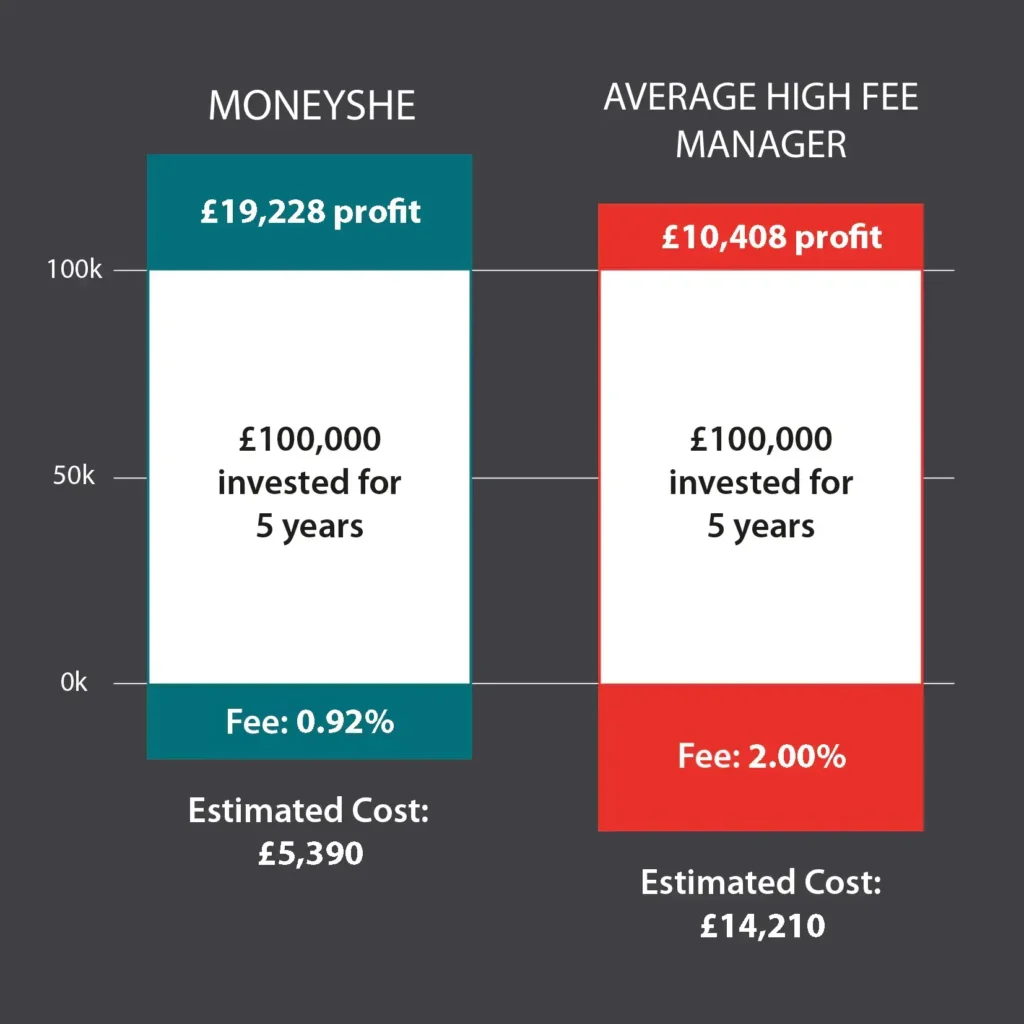

How MoneyShe's fees compare

Typical UK IFA wealth management fees are c. 2.00% per annum (Numis/FT 2023).

The average MoneyShe/SCM Direct Total Cost of Investing is c.0.92% per annum.

Due to the magic/mathematical force of compounding, what appears to be a small 1.08% per annum difference can have a dramatic negative impact on your investments over the medium to long-term.

If you invested two £100,000 pots over 5 years with two different companies — one charging 0.92% per annum and one charging 2.00% per annum, and both grow at 4.5% p.a. before costs; the pot with the lower-cost fund manager, your return via SCM Direct would have been £19,228 versus £10,408 with the higher cost investment manager.