9th October 2025

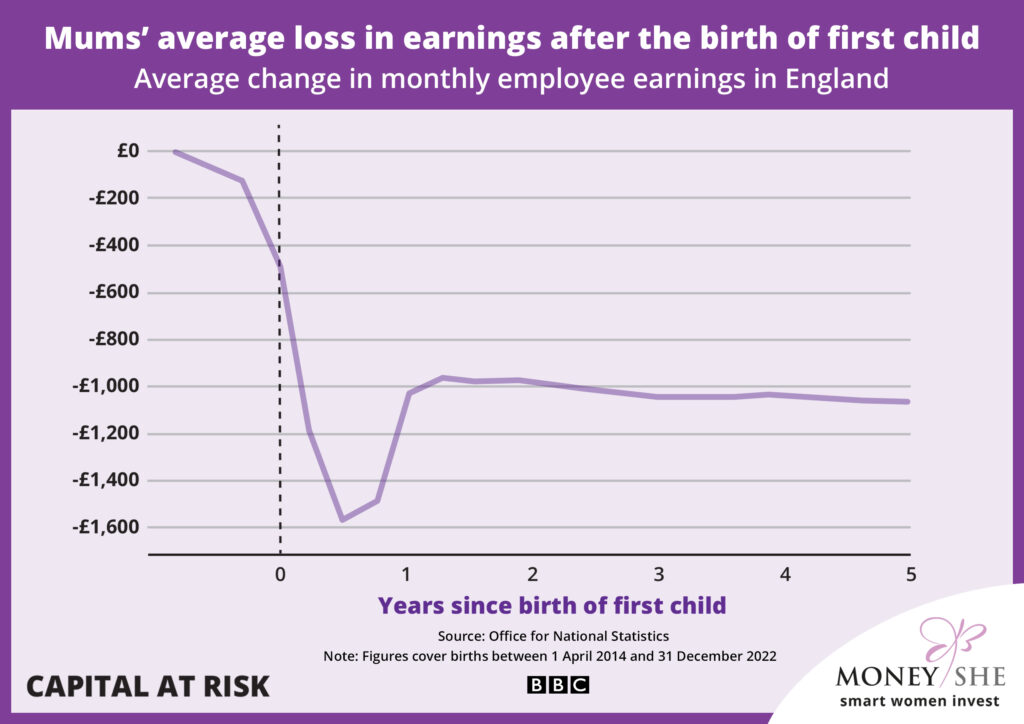

Having a child should be one of life’s most joyful milestones, not a trigger for financial loss. Yet in the UK today, becoming a mother can result in a staggering 42% drop in earnings over the five years that follow.

According to latest 2025 research by the Office for National Statistics (ONS), UK mothers lose an average of £65,618 in cumulative pay by the time their first child turns five.

And this is not a short-term blip – it leads to a long-term financial hit with compounding consequences.

The Real Cost of Motherhood in the UK

Let’s look at the key data contributing to this outcome:

- 42% income drop post-childbirth versus pre-birth earnings

- £65,618 average earnings loss in the five years after the first child

- £26,317 lost after a second child

- £32,456 lost after a third

The majority of these losses stem from reduced working hours, missed promotions, career stagnation, and lower pay upon re-entry to the workforce.

“This is not just a personal cost. The UK economy loses too through loss of talent, productivity, and potential when women are financially penalised for motherhood.”

Case Study: Anna’s Five-Year Financial Setback

Anna, 33, was earning £36,000 annually in a mid-level marketing role before her first child. She returned to work part-time, missing out on a promotion and annual bonuses. Her new monthly income dropped to £1,740 – about 58% of her previous salary.

Five years later, her cumulative shortfall = £75,600, not including lost pension contributions or slowed salary progression. Even as she increases hours later, she faces an uphill climb against peers who never paused for parenthood.

Anna’s story is not unique; it mirrors what is happening across the UK.

Why the Penalty Exists

The motherhood penalty is driven by several systemic factors:

- Career interruptions due to maternity leave and caregiving

- Shift to part-time or lower-paid roles for flexibility

- Missed promotions and reduced visibility at work

- Employer bias, often subconscious, about a mother’s “commitment”

- Cumulative compounding, where smaller salaries mean smaller raises, bonuses, and pensions

Together, these effects create consequences that can last decades.

The Bigger Picture: A National Issue

Beyond personal finance, the motherhood penalty has wide-reaching impacts:

- Gender Pay Gap: Parenthood is a key driver—responsible for up to 80% of the gap

- Retirement Inequality: Reduced pensions from lower lifetime earnings

- Unequal Impact: Single mothers and women from minority backgrounds are hit harder

The Hidden Economic Cost of Poor Childcare: Why the UK Can’t Afford to Lose Working Mothers

Let’s dig deeper into the wider economic cost and why this issue is not just one for women but everyone.

As thousands of women across the UK step back from their careers due to unaffordable or inaccessible childcare, the country faces a quieter but mounting financial crisis.

Whilst the recent ONS study revealed that UK mothers lose an average of £65,618 in earnings in the first five years after having their first child, behind that number lies a much larger issue. The fact that we as a country are systematically underutilising the talent and productivity of half the population. The result? A drag on national growth, household income, and long-term economic health.

Why Women Leave the Workforce

The core issue is clear – childcare in the UK is among the most expensive in the OECD. According to the OECD, British parents spend nearly a third of their income on childcare, well above the international average.

Faced with costs that often rival a second mortgage, many women are making a financially rational, but a nationally damaging decision to scale back or quit work entirely.

While men also face family pressures, it is overwhelmingly women who absorb the childcare burden. Whether due to wage gaps, social expectations, or inflexible working norms, women are more likely to adjust their careers around family life.

This dynamic isn’t just unfair – it’s inefficient.

The Economic Fallout

When women reduce or leave their participation in the workforce, the effects extend far beyond their own earnings, and the broader economy feels the impact:

- Lower Labour Force Participation: A smaller working population means slower economic growth. If more mothers remained in work, the UK’s GDP could rise substantially. In fact, if female employment matched male levels, the UK economy could gain tens of billions in annual output.

- Reduced Tax Revenue: With fewer women earning wages, the government collects less income tax and National Insurance. That’s revenue that could have funded better public services – ironically, including childcare.

- Greater Pressure on Public Services: Families that struggle financially due to lost income may need more support from state benefits, housing subsidies, or child allowances—costing the public purse even more.

- Skills Wasted: Talented, educated women dropping out of the workforce represents a vast waste of human capital. Years of education, training, and professional experience are left untapped— impacting innovation, leadership, and sectoral growth.

Suggested Fixes

Fortunately, there are ways to reverse this trend, and countries that have done so are reaping the benefits.

- Affordable Childcare Provision: Government-subsidised, high-quality childcare has been shown to boost maternal employment. For every £1 invested, returns in GDP growth, tax revenue, and reduced benefit reliance often exceed the outlay.

- Workplace Flexibility: Employers who offer remote work, job sharing, and flexible hours not only retain more women—they boost productivity, morale, and retention.

- Shared Parental Leave and Culture Shift: Policy must support—not penalise—families who want to share caregiving responsibilities more equally.

- Support for Re-entry: Career breaks for caregiving shouldn’t mean permanent penalty. Upskilling, mentoring, and return-ship programs can ease the path back to work.

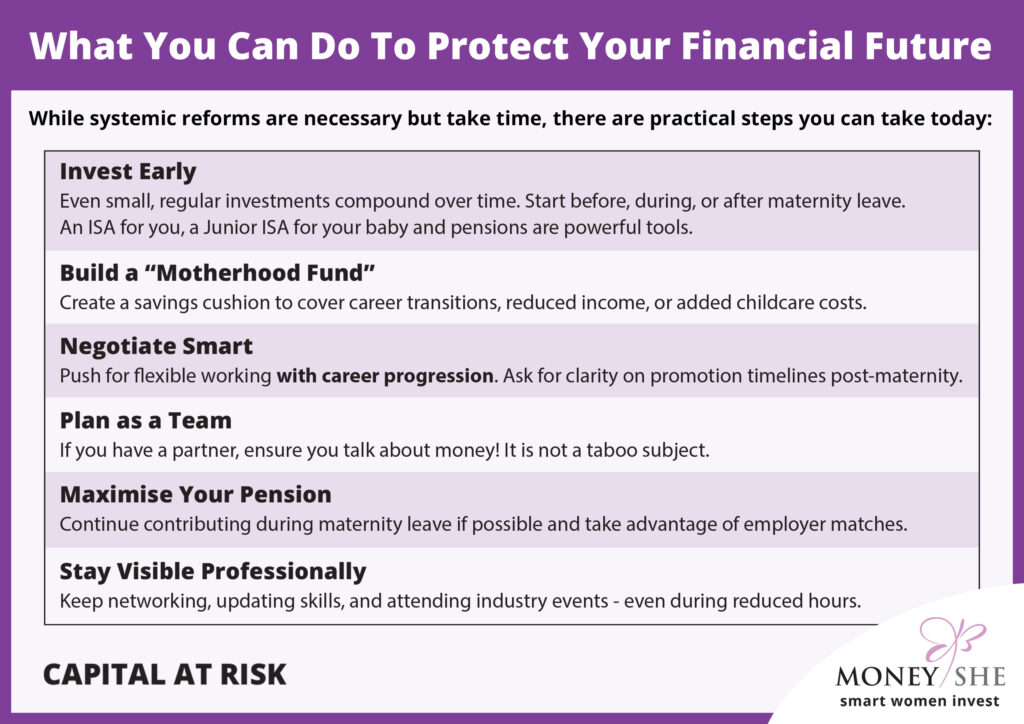

What You Can Do To Protect Your Financial Future

While systemic reforms are necessary but take time, there are practical steps you can take today:

How MoneyShe Can Help

At MoneyShe, we empower women to reclaim their financial power- especially during life transitions like motherhood.

Here’s what we offer:

✅ Easy-to-understand investment guides

✅ Access to low cost, risk-adjusted, highly diversified portfolios

✅ Quarterly Webinars

✅ Smart Tools for risk analysis and costs

We believe motherhood should never mean financial vulnerability. You deserve support, resources, and access to financial products that will look after your future financial health and wealth.

Final Word

The 42% earnings loss mothers face just isn’t – it’s a national challenge we all need to address.

But until policy and workplace reform catch up, women must act in their own interest and equip themselves and their family for a healthy financial future that affords a comfortable lifestyle, security and choices.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.