24 October 2025

When you hear about the “bubble” in stocks, it can feel like financial jargon meant to confuse. But it’s really a simple idea – one worth understanding, especially as we see some of the biggest companies in the world outpacing everything else.

Let’s break it down and look at what’s happening with the major tech/mega‑cap stocks – the “Magnificent 7” and highlight how this all matters to you and your money.

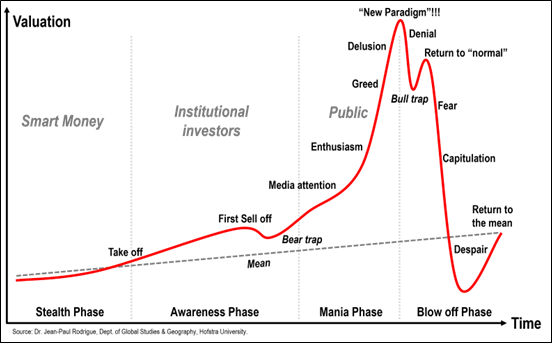

What is a bubble?

Think of a bubble like a balloon. You blow it up. It looks big, impressive, colourful. But if you keep blowing, the pressure builds – and at some point, pop.

In investing, a bubble happens when the price of an investment (a stock, sector, market) goes up far above what its fundamentals justify (things like profits, future growth, revenues). People keep buying because “everyone else is buying,” or because the story is irresistible e.g., “this company will change the world”. The risk is that the story doesn’t match reality, and when everyone realises the price is too high, and the value falls – it is often fast and painful.

Here are some key features of a bubble:

- A huge price increase in a short time.

- Very high valuation compared to earnings (i.e. paying a lot for each pound/dollar of profit).

- Lots of hype and expectation, sometimes irrational.

- Weakening connection between price and underlying business reality.

When things reverse, you don’t just lose a little — you risk losing a lot. That’s why spotting a bubble matters.

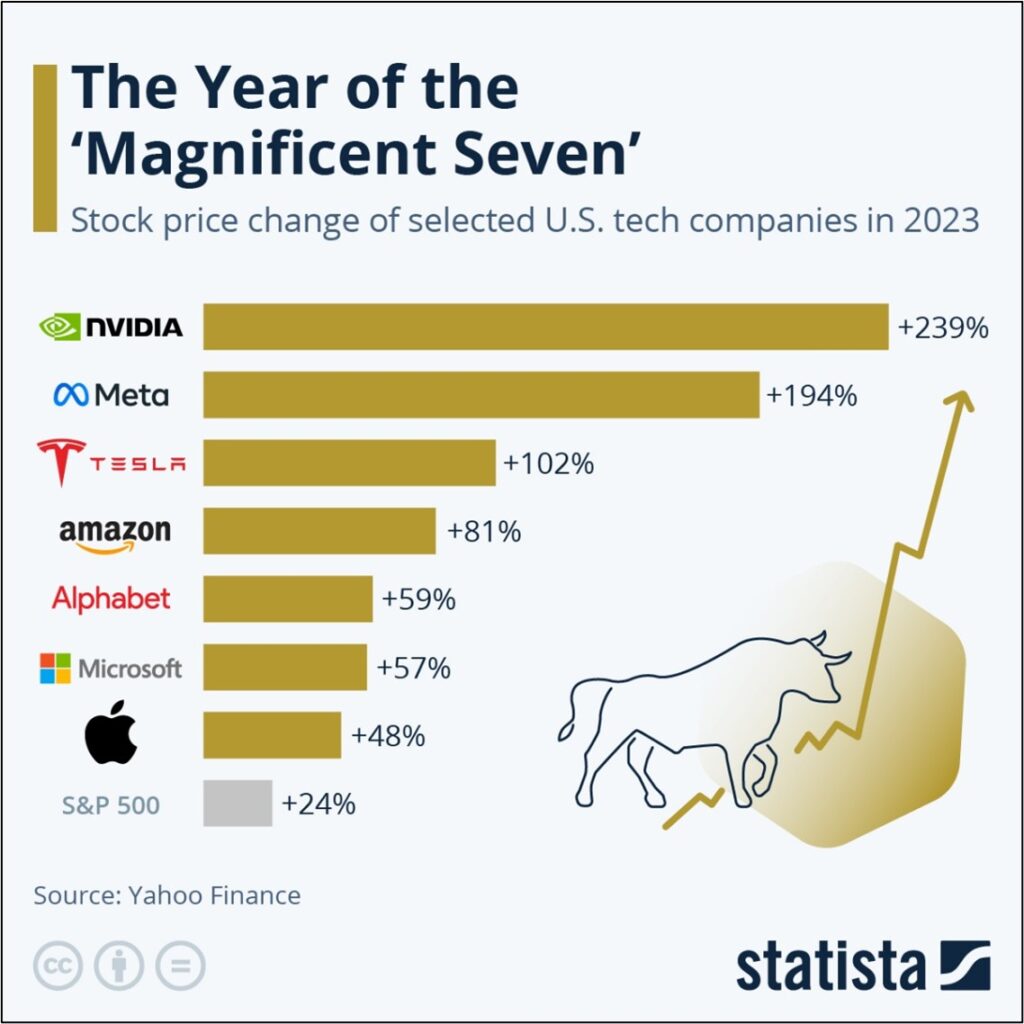

Who are the “Magnificent 7”?

The term “Magnificent 7” refers to seven huge US companies that dominate many indices, money flows and investor attention. They include:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Alphabet Inc. (GOOGL)

- Amazon.com, Inc. (AMZN)

- Meta Platforms, Inc. (META)

- NVIDIA Corporation (NVDA)

- Tesla, Inc. (TSLA)

These companies are massive and drive large parts of the US stock market and global indices.

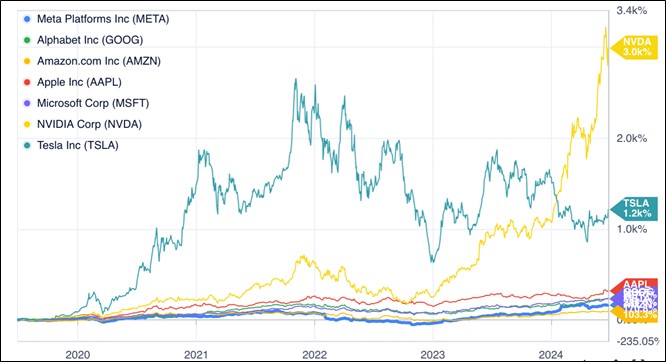

And here’s what’s interesting: they’ve had incredible run‑ups in price. For example, in one chart they showed huge percentage gains in recent years.

With this kind of dominance and price increase, many analysts, including here at MoneyShe, have been asking: Is this just growth — or is this a bubble?

We believe a bubble is forming – the “elastic band” analogy

Two blogs from our Chief Investment officer, Alan Miller, earlier this year talks about stretching an elastic band until it snaps. In other words: how far can the market (or a set of stocks) be pulled up before it breaks back down? SCM Direct

Here are the main take‑aways from that analogy:

- The “elastic band” = the valuation, the hope, the expectations built into stock prices.

- Stretching = investors keep bidding up the stocks because of the growth story, momentum, fear of missing out.

- The “snap” = a correction, where reality bites, and the price falls.

As Alan says, our “contrarian mindset” leads us to ask: “How far can you stretch an elastic band before it snaps?” SCM Direct

What us cautious and worried about the Magnificent 7?

- These stocks represent such a large share of the market that the risk of a correction is amplified.

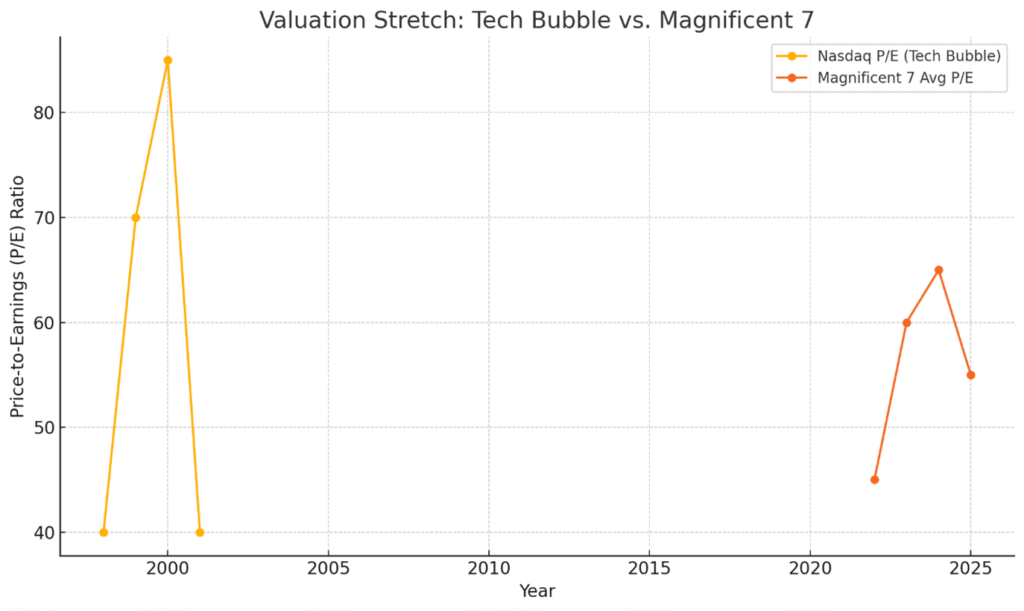

- Valuations look stretched: high multiples relative to earnings or fundamentals.

- If a shock hits (macro, regulatory, tech disruption, competition), it could trigger a rapid unwind.

What You, As An Investor Should Watch Out For

If you’re exposed to one or more of these stocks – or more broadly to tech/mega‑cap growth – here are red flags to keep top of mind:

- Valuation vs profit – If a stock is priced for perfection (i.e., it must deliver future growth or else), you are vulnerable. Some data show the Magnificent 7 are trading at higher price/earnings ratios than broad markets.

- Over‑concentration – If your portfolio relies heavily on just a few stocks, you might ride the high when they go up – but you’ll feel the pain when they come down.

- Hype vs reality – Big stories (AI, self‑driving, metaverse, etc.) can grab headlines. But if the company fails to deliver, the stock price can lose momentum quickly.

- Liquidity and emotion – When people buy because everyone else is buying, rather than because the fundamentals make sense, things can reverse fast. Also: once the sentiment turns, selling becomes urgent, which can magnify losses.

- External shocks – A regulatory change, interest‑rate rise, supply‑chain issue, or disruption in tech could hit these companies especially hard given their size and expectations.

The Risk: Losing Money

Speaking plainly – these stocks are huge and expensive, so the potential downside is significant. Here’s how you could lose money:

- If one of the companies fails to meet the sky‑high expectations, the stock price might drop sharply.

- If the broader market shifts (say interest rates rise, or investors rotate out of growth into value), these high‑fliers might fall faster than smaller or cheaper stocks.

- If you bought in after a large rise (say chasing the wave), you may have less upside and more downside risk.

- If your portfolio is heavily tilted to the Magnificent 7 and they drop 30‑50%, your losses will hurt more.

To use the balloon analogy again: If you wait until the balloon is huge and then try to get out exactly at the top – you might be too late.

So, What Should You Do?

Here are practical steps, especially for women who want to feel confident about their investing, and not be scared by headlines:

- Check your exposure: How much of your investment money is in one or two mega‑stocks? If it’s a lot, maybe consider diversifying.

- Focus on fundamentals: Companies are only worth what they can reasonably earn and grow. If the price assumes much more, there’s a gap.

- Balance your portfolio: Mix growth with value, smaller companies, and other assets (international, bonds, etc).

- Stay grounded, not emotional: If you feel you’re buying because “everyone else is,” ask whether the fundamentals support it.

Final thought

Yes, the Magnificent 7 could continue to climb. They are powerful companies. But the very magnitude of their rise and valuation puts them in bubble territory or at least puts them at risk of a bubble‑style correction.

As an investor – and anyone who cares about not just gains but preserving money — it’s smart to understand this bubble risk, be cautious, and not assume the good times go on forever.

How MoneyShe can help you

At MoneyShe, we’re professional investors who take the hard work out of investing, so you can get on with your life knowing your money is being looked after carefully.

We manage your wealth in a way that’s risk-appropriate, low-cost, and diversified, so you don’t have to stress over market bubbles or stock picking. You can be confident that your investments are built to last, with experts keeping an eye on risk and return — not hype and headlines.

We handle the complexity – while you carry on focusing on what matters most to you.

Here’s what we offer:

- Easy-to-understand investment guides

- Access to low cost, risk-adjusted, highly diversified portfolios

- Quarterly Webinars

- Smart Tools for risk analysis and costs

- A Matchmaker Risk Questionnaire to determine your level of risk

- A free introduction wealth management call with our friendly investment team.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.