Reeves ISA Reforms – 5th December 2025

If you’re thinking of opening a new ISA, or have your money in a Cash ISA, but you want or need to put money into stocks and shares combined with the Chancellor’s new reforms to Cash ISAs, you may be nervous about the markets – but you’re not alone.

The recent government move that reduce the amount you can hold in a tax-free cash ISA, means many savers are re‑assessing their options. Something we have always highlighted with savers is that saving in cash leaves you exposed as inflation means your savings are unlikely to grow so you can afford the same things tomorrow, that you buy today, due to inflation – e.g. real returns. But we understand that many people may be reluctant to invest due to a low-risk appetite. The good news is that even if you are a low-risk investor, this doesn’t always mean missing out on growing your money.

There are lower-volatility investment option within your Stocks & Shares ISA such as our MoneyShe Liquidity Reserve Portfolio offering a lower-risk investment approach, designed to reduce volatility while keeping your money invested. It’s available within a Stocks & Shares ISA and may suit investors looking for capital stability over short to medium terms

What do we mean by “risk”?

In the context of savings and investing, “risk” refers to the possibility of losing money or not keeping up with inflation.

- A low‑risk investment means your capital (the money you put in) is more likely to stay intact, though returns may be modest.

- A higher‑risk investment may offer higher returns over time – but comes with greater chance of short-term losses or volatility.

Your best option depends on your comfort with risk, your financial goals, and your time horizon (when you’ll need the money).

ISA is a Tax-Free Wrapper, It’s What You Put in it That Counts

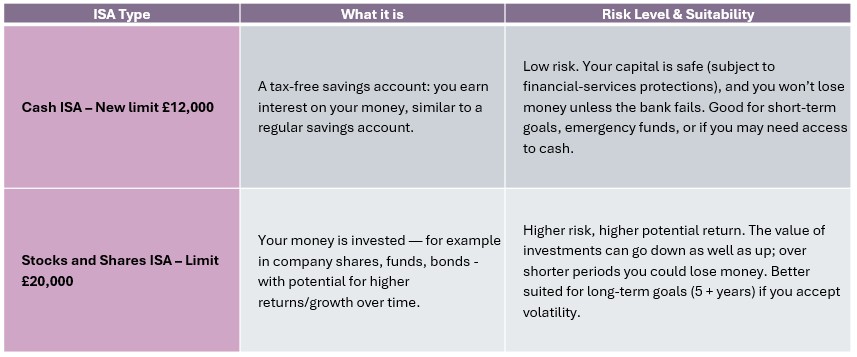

The UK tax-free wrapper known as the Individual Savings Account (ISA) lets you shelter savings or investments from UK tax. The main types relevant to most savers are:

- Cash ISA

- Stocks and Shares ISA

There are others – e.g. Lifetime ISAs, Innovative Finance ISAs – but for most low‑risk investors, the first two are usually most relevant.

Here’s a quick breakdown:

Cash savings in UK banks and building societies are protected by the Financial Services Compensation Scheme (FSCS) up to a limit of £120,000 per person, per authorized firm. This protection applies to deposits like current accounts, savings accounts, and cash ISAs. Joint accounts are protected up to £120,000 per person, meaning a total of £240,000 for the account.

Because ISAs are tax-efficient (you pay no UK income or capital gains tax on interest or investment growth), they’re great tools for both cautious savers and long‑term investors.

Cash ISAs Budget 2025 Shake-Up – and What It Means for Risk‑Averse Savers

On 26 November, in the Autumn Budget, the UK government announced plans to reduce the annual allowance for cash ISAs from £20,000 to £12,000 starting in 2027.

The idea behind the change is to encourage savers to shift from “safe but low-yield” cash accounts to investments, especially into UK equities, to stimulate retail investing and support broader economic growth.

However, many experts – including MoneyShe and our parent company SCM Direct, argue the reform won’t work as intended, because risk‑averse savers aren’t just motivated by tax allowances; they value capital security and access to cash!

What that means for you: If you’re low‑risk and value security over growth, cash ISAs remain relevant – especially before the allowance drops. BUT you may also want to consider more flexible “hybrid” solutions.

A “Balanced‑Risk” Approach: Combining Safety and Growth

For many savers, the decision doesn’t have to be “all cash” or “all investing.” A balanced, hybrid approach might fit best – especially if you’re cautious but still want to stay ahead of inflation. Here are two sample investor profiles:

- Profile A — Security‑First Saver: You want to preserve your capital, you might need access soon, or you use the ISA as an emergency fund.

- Best option: Cash ISA

- Why: Your savings are safe and accessible. Tax‑free interest, no risk of a sudden drop.

- Profile B — Slow‑Grower, Low‑Volatility Investor: You want some growth over time but can tolerate only mild fluctuations in the stock market.

- Balanced approach: Part in Cash ISA – say £10,000 and part in a conservative Stocks and Shares ISA (e.g. a liquid portfolio holding cash ETFs.

At MoneyShe, we recognise this demand and offer a “Liquidity Reserve Portfolio” that invests in three cash-based ETFs (exchange-traded funds) aimed at combining liquidity, simplicity, low fees and higher returns. That kind of approach sits between Cash ISAs and full Stocks & Shares ISAs.

Opening a New ISA — Tips for Low‑Risk Investors

- Clarify your time horizon and goals. Need the money in a year or two? Use a cash ISA. Saving for 5+ years? Consider mixing cash with a diversified mix of investments.

- Stay diversified. Even if you go partly into stocks, consider diversified funds or mixed-asset portfolios – they tend to smooth volatility over time. (read our blog on Diversification here: Why Modern Women Need the Power of Diversification )

- Think about flexibility. Some cash ISAs are “fixed-rate” – locking in your money for a period, others allow easy access. If you are unsure of the next year or two, choose a flexible or easy-access version.

- Split your ISA allowance if needed. You don’t have to put the full £20,000 a year into one ISA. Think about splitting it 50/50 so you are better able to match your risk and goals.

- Watch the broader context. With changes to UK ISA rules, cash ISAs may become less attractive over time – but that doesn’t mean cash or low‑volatility options will disappear. We envisage that investor behaviours will lead to more hybrid products such as our MoneyShe Liquid reserve Portfolio – mixing cash and cash‑equivalent assets.

The MoneyShe Liquidity Reserve Portfolio is made up of three ETFs:

- A £ Ultrashort Bond UCITS ETF GBP

- A $ Floating Rate Bond UCITS ETF GBP Hedged

- A Smart Overnight Return GBP Hedged UCITS ET

These are listed, regulated investment funds exposed to credit, currency, and interest rate risks. The portfolio is regularly reviewed by our investment team to ensure clients are holding the best ETFs.

Final Thought

If you open a new ISA and have a low-risk appetite, the default safe bet remains a Cash ISA – especially if you value security and easy access. But there’s nothing wrong with mixing in a gentle, diversified investment approach if you can tolerate modest fluctuations and want to aim for better long‑term returns.

With the regulatory environment shifting, now is a good time to think carefully about what you want from your savings: stability, growth, flexibility – or a bit of all three.

The MoneyShe Liquid Reserve Portfolio is only available on request – so contact us on equiries@moneyshe.com or call Zoe on 020 7838 8650 to book a Zoom call with one of our Investment Team.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.