The old Saying ‘location, location, location’ holds true in house buying. For investing, its ‘diversification, diversification, diversification’.

Investing doesn’t have to feel high stakes. Imagine your money as a garden: a single type of flower might look stunning, but if pests or bad weather strike, you could lose everything. Diversification is like planting a mix of flowers, herbs, and shrubs – creating a resilient, thriving ecosystem that can weathers most storms.

Let’s explore how this approach can protect your investments and helps them grow steadily over time.

‘All Your Eggs in One Basket’ Is Risky

Putting all your money into a single stock, sector, or even a savings account leaves you vulnerable. If that investment falters, due to a market dip, company scandal, geo-political occurrences or economic shift, your entire portfolio would take a hit.

With the unprecedented occurrences, especially in the US, unpredictability surrounding markets today and the volatility we’ve experienced so far in 2025, having a properly diversified portfolio ready for any economic storm has become even more important than ever.

Whilst it’s easy to feel helpless, when it comes to your investments, diversification spreads your risk across different assets, so a loss in one area doesn’t derail your entire plan. Think of it as a financial safety net – if one part slips, others are there to catch you by reducing risk and enhancing your portfolio resilience.

How Investment Portfolio Diversification Works and Smooths Out the Bumps

- Balancing Act: Different assets behave differently. Stocks might soar while bonds hold steady, or one country’s equity gains offset a temporary drop in another’s. This mix reduces extreme ups and downs, making your returns smoother by reducing sharp ups and downs.

- Long-Term Consistency: A diversified portfolio won’t always “win big,” but it’s less likely to crash. Over time, steady growth compounds, building wealth reliably. More on this below.

- Global Opportunities: Investing across regions and industries lets you tap into growth trends wherever they are happening.

Whilst the focus of this blog is diversification as a powerful force for investing, I want to expand a little on long-term consistency and compounding which are also powerful positive forces.

Long-term consistency and steady growth are investing principles that lead to significant compounding effects over time.

Benefits of Long-Term Consistency

- Riding out market volatility: Long-term investing allows you to weather short-term market fluctuations. Historical data shows that over extended periods, markets tend to recover and grow. It’s vitally important to remember this during difficult economic times such as the period we are seeing at present.

- Emotional detachment: Try to ignore those headlines! A long-term approach removes the emotional aspect of investing, preventing impulsive decisions based on short-term market movements.

Long-term consistency and steady growth are powerful forces in investing, leading to significant compounding effects over time.

Compounding – the 8th Wonder of the World

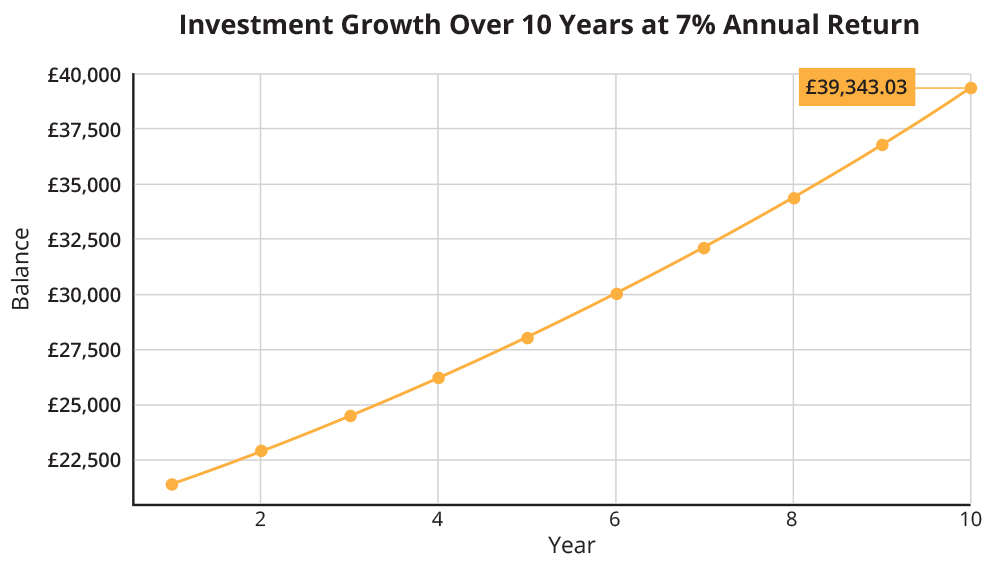

According to Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” At first this quote might seem like a bit of an exaggeration but the math behind it shows that it is not.

For investing, compounding occurs when you earn returns not just on your initial investment, but also on the accumulated gains from previous periods. This creates an accelerating growth curve that can lead to substantial results over longer time periods. Over time, you earn returns not just on your initial investment, but also on previous gains, creating a snowball effect.

Simple Ways to Diversify

Mix Asset Types: Combine stocks (for growth), bonds (for stability), and alternatives or commodities lowers your investment risk. As professional investors, the MoneyShe investment team’s diversification strategy includes:

- Spreading across industries: Tech, healthcare, and consumer goods rarely rise and fall in sync.

- Going global: Include international investments to avoid relying solely on your home country’s economy.

- Rebalancing regularly: Adjusting our client’s portfolio mix to maximise opportunities, reduce risk and costs and increase returns.

Diversification Bottom Line

Diversification isn’t about chasing the highest returns. It’s about creating a resilient plan that lets you sleep soundly.

By spreading your investments, you are more protected against sudden losses and are positioned to benefit from growth wherever it happens.

At MoneyShe – our mantra is: be vigilant and ready to rebalance, keep it simple, and let time work its magic.

Let us be your pocket professional wealth manager – Your future self will thank you! ????

If you would like to find out your investment risk tolerance, try our FREE Matchmaking Tool here . If you’re ready to invest, book your free investment call here.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.