18 September 2025

A SIPP (Self‑Invested Personal Pension) offers you more control over how and where your pension is invested, but that freedom comes with responsibility. One of the smartest actions you can take is Diversification: spreading your money across various investment types to reduce risk and boost potential long-term growth.

When building your pension pot, diversification isn’t optional—it’s essential. Don’t put all your eggs in one basket.

What Is a SIPP and Why Does Diversification Matter?

A SIPP lets you hold a wide range of investments in a tax-free pension wrapper (restrictions apply) – from stocks to ETFs, bonds, and even commercial property.

But even with this flexibility, you can still end up too concentrated. For example, putting too much into one fund, one ETF, one region, or one sector. If that sector struggles (as tech did in 2022, or UK mid-caps during Brexit volatility), your whole retirement pot could take a hit.

🟣 Example:

- Not diversified: £80,000 in UK property funds alone

- Diversified SIPP: £80,000 split between UK equities, global equities, bonds, and alternatives like infrastructure.

Diversification Strategies for SIPP Investors

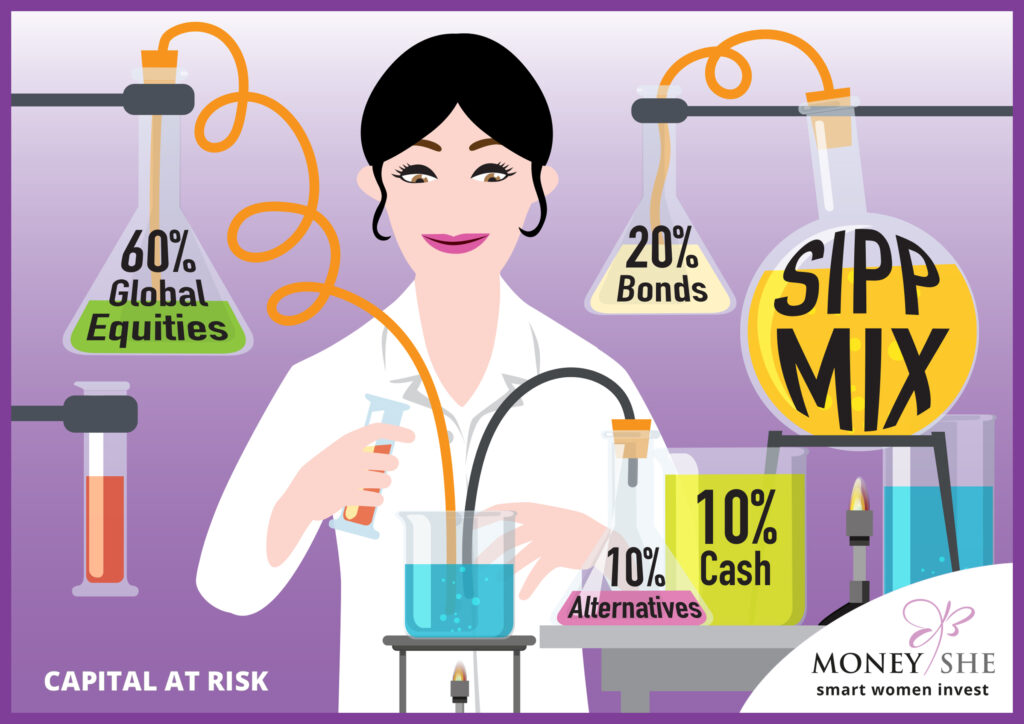

1. Asset Class Mix

Don’t go all-in on equities – especially as you approach retirement. Blend assets with different risk levels.

🟣 Suggested SIPP Mix (Age 40–55):

- 60% Global equities

- 20% Bonds (e.g. corporate or gilt funds)

- 10% Alternatives (gold, infrastructure, REITs)

- 10% Cash or money market fund (for flexibility)

Why it works: Equities grow the pot; bonds and alternatives steady the ship.

2. Sector Spread

Ensure your equity investments aren’t concentrated in just one sector like tech, energy, or healthcare.

3. Geographic Diversification

Avoid a “home bias.” Many UK investors over-expose themselves to UK companies, even though the UK is just 4% of global markets.

🟣 SIPP-Friendly Options:

- Vanguard FTSE All-World ETF – 3,500+ global stocks

- Fidelity Asia Fund – Access to long-term growth in China, India, South Korea

- iShares S&P 500 ETF – U.S. giants like Apple, Amazon, Microsoft

4. Lifecycle Adjustments

As you get older, you should be reviewing your SIPP mix and evolving your holdings.

🟣 Example glidepath:

- Age 30–45: 80% equities, 20% bonds

- Age 45–55: 60% equities, 30% bonds, 10% cash

- Age 55+: 40–50% equities, more in bonds, maybe annuity prep

📌 Tip: Alternatively, you could hold 80% in an age-appropriate mix as above and hold 20% in a higher risk/higher reward portfolio such as the MoneyShe Equity Portfolio. A serious consideration if you have left investing to later in life as you have less years to grow your wealth.

5. Example: Concentrated Traditional Absolute Return Fund versus the Modern MoneyShe Absolute Return Portfolio

Concentrated Traditional Absolute Return Fund:

Take the Fidelity Contrafund (FCNTX) as an example. It’s a large but highly concentrated US equity mutual fund. As of 2025, its top holdings include Meta Platforms (17%), Berkshire Hathaway (9%), Nvidia (8%), Amazon (6%), and Microsoft (5%). This fund takes bold positions in just a handful of high-conviction names, making its performance sharply tethered to those few stocks. True it can offer high reward but also increased volatility, and risk especially if/when the tech bubble bursts.

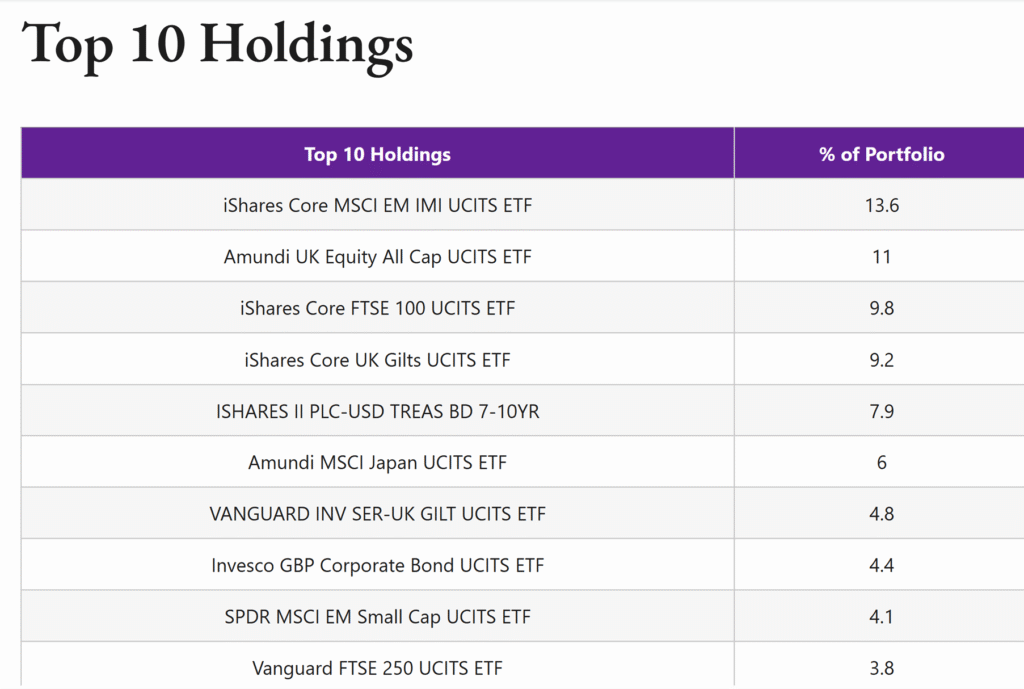

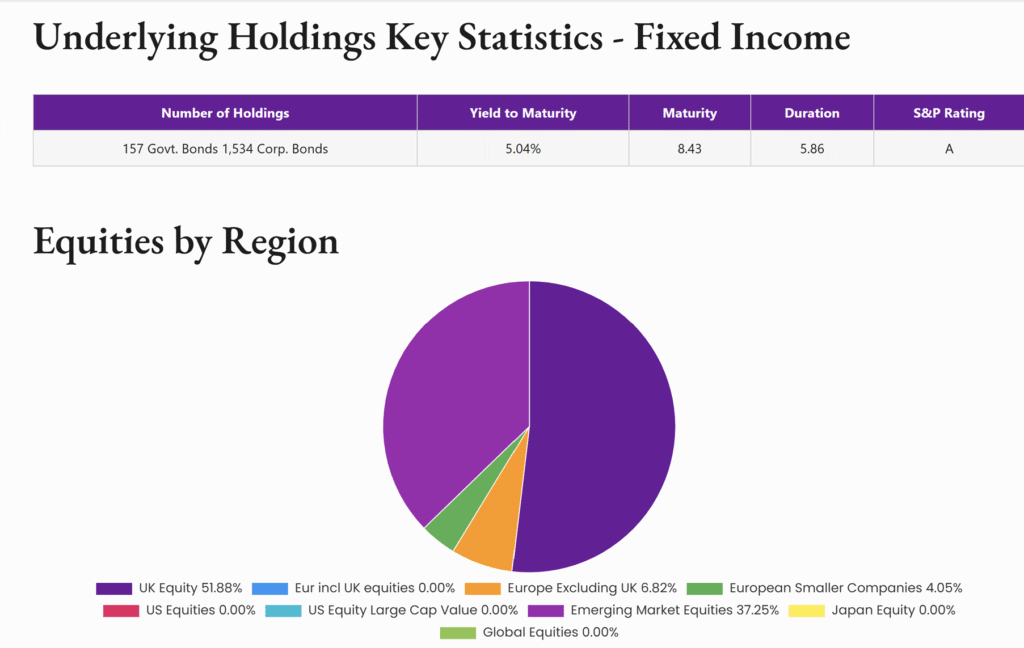

In contrast, the MoneyShe Absolute Return Portfolio holdings are below:

And underlying holdings

Mistakes to Avoid with Your SIPP

🚫 1. Too many similar funds

Holding 3 different UK equity funds? You’re not diversifying – just duplicating.

🚫 2. Overreacting to market noise

Panic-selling during dips harms long-term returns. Avoid reacting to headlines and hold your diversification nerve as your portfolio is more likely to recover better.

🚫 3. Ignoring fees

High-fee active funds, high entry or exit fees and other fees all add up and come out of your money. ETFS are particularly good for achieving diversification and growth at low cost. Make sure you know ALL the fees – including SIPP fees which can vary hugely. Find out all about the MoneyShe SIPP here https://moneyshe.com/products/#sipp

Final Thoughts

With a SIPP, you’re in the driving seat – but every driver needs a good map.

Diversification is that map.

It protects your future, reduces volatility, and avoids bumps along the way ensuring your pension is working for you, not against you.

At MoneyShe, we believe every woman deserves financial independence and clarity – and that includes knowing what’s in your SIPP and why.

💡 Want Help Building Your Own Diversified SIPP?

- Check out our MoneyShe Insight and resources

- Use our SIPP charges provided here by our parent company SCM Direct

- Try our MoneyShe Investment Matchmaker Risk Questionnaire

- Book a call with our friendly MoneyShe investment team

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.