Fed Credibility, Political Pressure, and the Return of Risk

December was also a month of political noise, as President Trump’s administration intensified pressure on the Federal Reserve, including an unprecedented subpoena against Chair Powell. While markets initially shrugged, concerns grew about the politicisation of monetary policy and whether the Fed could maintain independence through the election cycle.

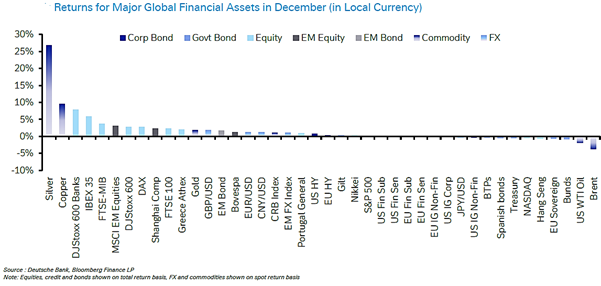

Despite this, market expectations of rate cuts in 2026 have begun to recede. Core inflation remains sticky, and trade-related pass-through continues to feed into consumer prices. The US dollar, which had weakened sharply earlier in the year, regained ground in December as markets reassessed the global growth and policy divergence narrative.

MoneyShe Portfolios: Strong Performance, Steady Discipline

MoneyShe Portfolios ended the year in a strong position, benefitting from disciplined strategies and decisions throughout a volatile and distorted market cycle. The early October reduction in equity exposure (within the Multi-Asset Portfolios) by between 15 to 18% proved prudent, locking in gains and reducing exposure to increasingly frothy market segments.

In portfolios where permitted, we shifted proceeds into high-quality government bonds, particularly UK gilts and US Treasuries, to avoid overreliance on credit spreads, which have reached historically ultra-low levels.

Looking ahead, the opening weeks of 2026 suggest that volatility is not behind us. New tariffs on European exports, uncertainty over the Fed’s direction, and a crowded geopolitical calendar all present risks. But the lessons of 2025, namely valuation discipline, thematic diversification, and proactive rebalancing, will remain at the core of our MoneyShe approach.

Alan Miller, Chief Investment Officer

19 January 2026