Imagine a world where every pound you save today does not just sit there – it grows, adapts, and outsmarts inflation to give you real choices tomorrow.

Choices like leaving a job that doesn’t fulfil you, starting a business, facing life changes such as divorce or illness without the added burden of financial stress, or securing your retirement in comfort. This isn’t a fantasy; it’s about understanding real returns – inflation-adjusted growth that turns savings into genuine financial power.

Let’s unpack how women can harness this superpower.

Why Real Returns Matter More Than Ever

Most cash savings accounts and “safe” investments are quietly losing value. In 2021, UK easy-access savings accounts delivered a dismal -5.23% real return after inflation, while global equities soared by 17.5%. The difference? One shrinks your purchasing power; the other protects and builds it.

The Double Whammy of Inflation and Fees

- Inflation’s stealth tax: Even moderate inflation (like today’s 3 – 4%) can hollow out your returns. A “safe” savings account paying 4% today? Subtract inflation, and your real return is near 0!

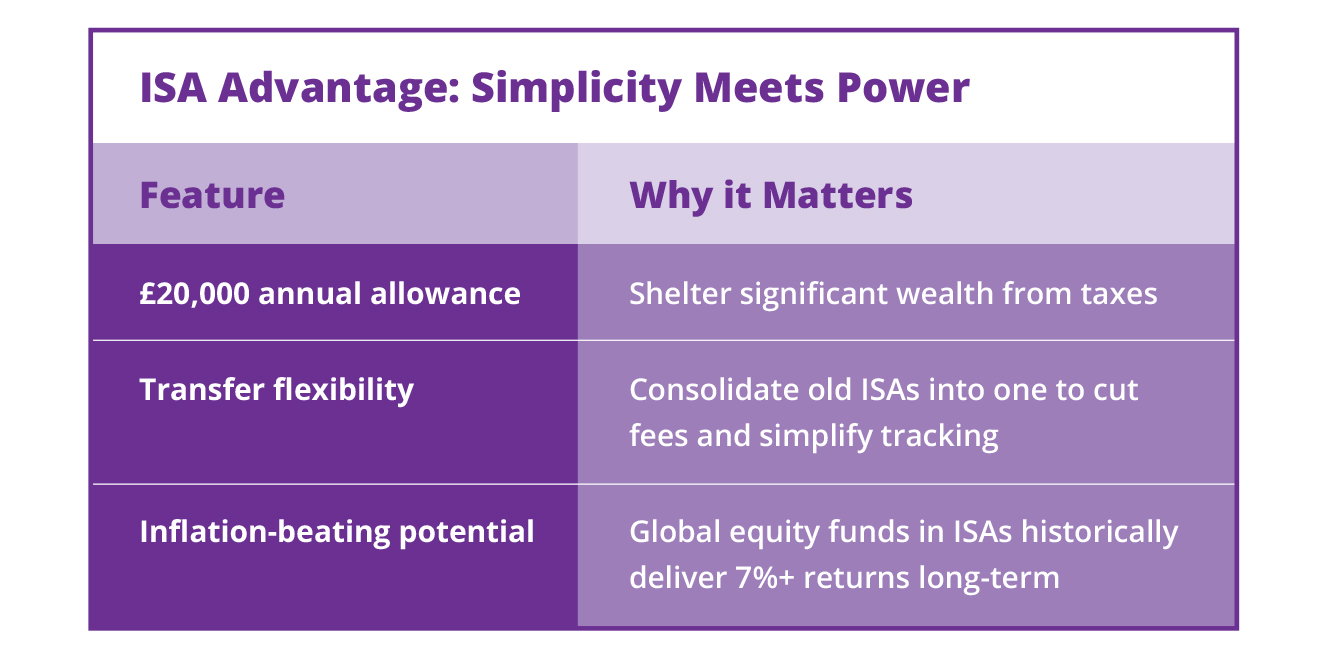

- Crush fees, boost returns by avoiding ‘fee creep’: A 2% annual fee might seem small, but over 20 years, it can slash £16,000 from a £20,000 investment growing at 7.5%. Opt for a low-cost platform charging 0.9%, and you keep thousands more.

For women, this gap is critical as we face systemic hurdles:

- Globally, women’s lifetime earnings are $172.3 trillion less than men’s.

- Only 23% of women feel confident managing long-term investments.

- Yet, when women do invest, they outperform men by 1.8% points annually.

Real returns aren’t just numbers – they are tools to tackle these stats.

Strategies to Chase Real Returns and Real Freedom

Avoid the Savings Trap, Embrace Equities (Stocks and Shares)

The data is clear: over a 5-year period, equities historically outpace inflation by 2-3% annually on average.

Even small, regular investments in low-cost index funds such as ETFs (Exchange Traded Funds) can compound into meaningful wealth building.

Take Up Your Tax Efficiency and Accessibility of an ISA

You keep 100% of gains: Stocks and Shares ISAs aren’t just tax shelters – they’re freedom accelerators. No capital gains or income tax on returns, even when tax rates rise.

Easy access: If you invest in a well-diversified, liquid, low-cost stocks and shares ISA you can have money back into your bank account within 5-7 working days.

Lean Into Your Strengths

Women excel at two investment superpowers:

- Patience, an investment virtue: women are more likely to think longer term, trade less frequently and are more interested in consistent returns than ‘Wolf of Wallstreet’ returns and risk taking

- KISS – keep it simple, stupid. Women tend to ask the smart, simple questions that can make a real difference – especially on fees, who’s earning what and exactly where they’re invested.

The Ripple Effect: More Returns, More Choices

When women control wealth, everyone benefits:

- Families see better health and education outcomes.

- Communities thrive as women reinvest more of their earnings to local causes and communities versus men.

- Economies grow: According to the World Bank and various other economic studies, closing the gender investment gap could increase GDP by more than 20%, which translates to a significant boost to the economy, potentially adding millions of pounds in new economic activity.

Key points about the economic impact of closing the gender investment gap:

Significant GDP increases via the Female Economy

Closing the gender gap, gives women choices that can lead to in increased employment and entrepreneurship which has the potential to improve GDP by as much as 20%.

Increased productivity

By utilising the full potential of women in the workforce, our economies can experience a significant boost in productivity.

When women have equal access to funding, it can lead to a surge in new female-led businesses, driving innovation and economic growth.

Your Action Plan

Emergency cash: work out how much your expenses and outgoings are for six months and put that sum away in a high interest cash account

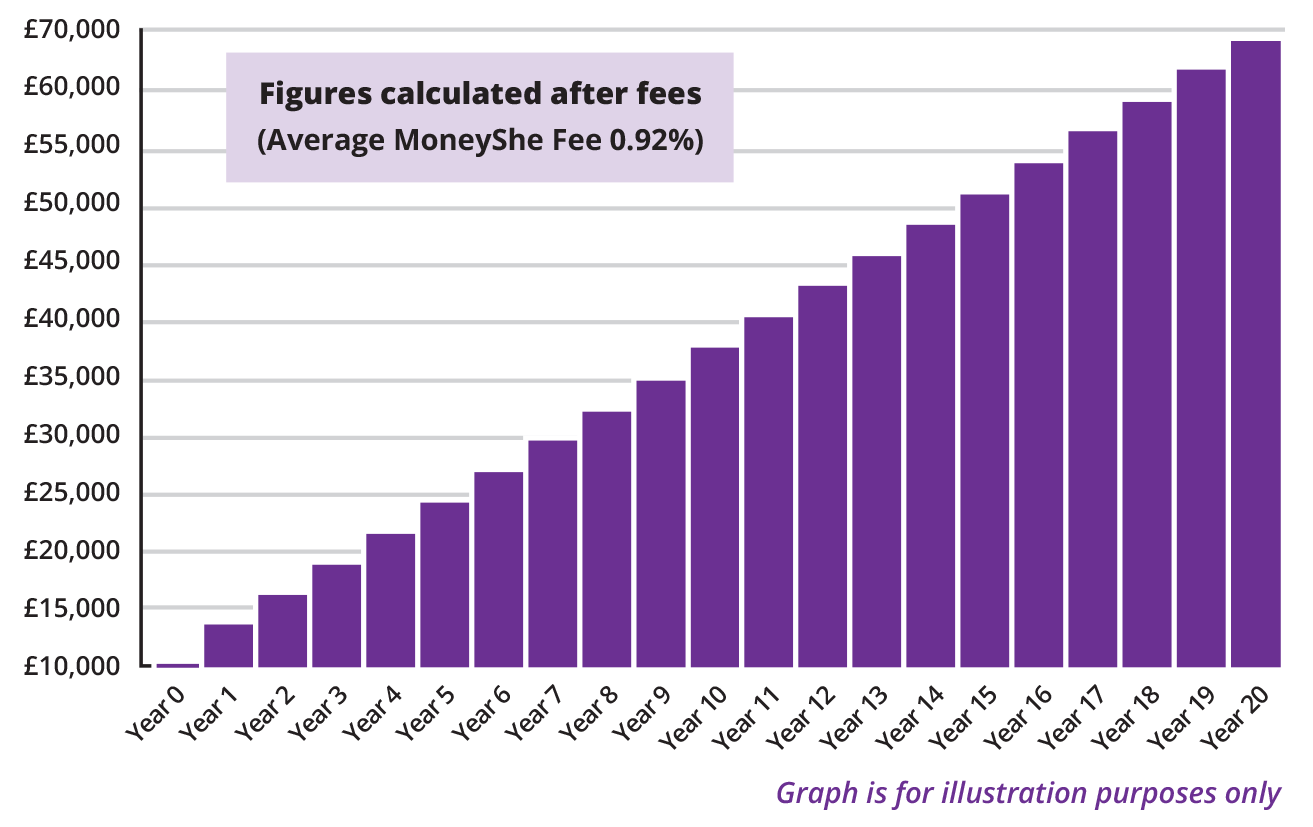

Invest in Future You: Start small BUT start now: If you invest £10,000 initially in a stocks and shares ISA or a Self-Invested Personal Pension (SIPP) and then contribute £200 per month for 20 years at a 7% annual return, your investment could grow to approximately £68,000.

Explanation:

Total contributions: Over 20 years, with monthly contributions of £200, you would contribute an additional £48,000 (20 years x 12 months x £200) on top of your initial £10,000.

Compounding interest: The key factor is the power of compounding interest, where returns are earned not only on your initial investment but also on the accumulated interest over time, allowing your money to grow exponentially.

Calculation: Starting amount of £10,000, monthly contributions of £200, a 7% annual return, and a 20-year investment period, the final amount would be approximately £68,000.

Important considerations – Market fluctuations: This calculation is based on an assumed 7% annual return, but actual market returns can vary significantly and may be higher or lower depending on the investment chosen.

Fees and taxes: Investment fees and taxes can impact your overall returns.

Diversification is key: To reduce risk, it’s important to diversify your investments across different asset classes.

How to Build Wealth: The Bottom Line

Real returns aren’t just about beating inflation – they’re about beating life’s limitations.

Every percentage point gained is a step toward a life where your money doesn’t just exist, it is really working for you. Let’s build that future, one informed choice at a time.

As Melinda Gates said “When money flows into the hands of women, the lives of people all over the planet are better” because it can help to reduce poverty, increase economic growth, and improve health and education.

MoneyShe is committed to making it flow faster.

If you would like to find out your investment risk tolerance, try our FREE Matchmaking Tool here . If you’re ready to invest, book your free investment call here.