30th October 2025

Ladies, it’s that time again – the Autumn Budget on 26th November, and while we can’t control what’s in it, it tends to be a time that concentrates our minds on money matters, and what we can control.

If you’re someone who grew up without learning the “language of money,” don’t worry – you’re not alone. Many of us weren’t taught the language of finance and how to make our money work for us.

Let’s fix that, starting today with some simple, no-stress ways to save money, cut waste, and find ways to put money away and grow a nest egg for the future.

Credit Cards: Friend or Foe?

Credit cards can feel scary – all those interest charges! But if used wisely, they can save you hundreds.

Smart Move:

- Check what you’re paying in interest (APR).

- Use a comparison site to see if you could switch to a 0% interest balance transfer deal.

- Pay off as much as you can monthly to avoid fees.

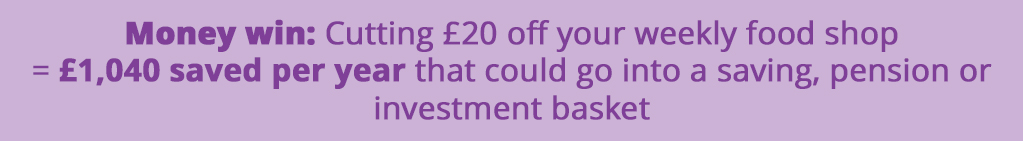

Supermarket Smarts: Trim That Food Bill

Weekly shops add up. But with a few tweaks, you could save without giving up your treats

Smart Move:

- Shop with a list (and a full stomach!)

- Plan 3 – 4 dinners in advance to avoid waste

- Don’t snub store-brand or budget shops like Aldi and Lidl – they can be so much cheaper without sacrificing quality.

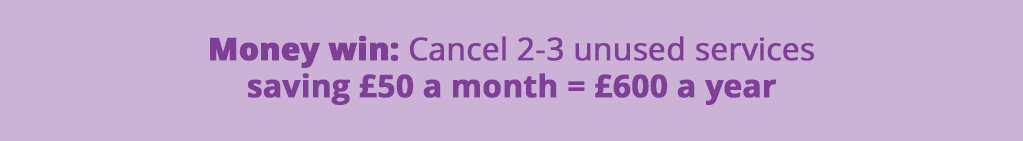

Subscriptions, Standing Orders, Sneaky Outgoings in Your Statement

It’s so easy to sign up to streaming, fitness, magazine/news subs – but do you actually use or need them? Go through your last three bank statements and cancel what no longer works for you.

Smart Move:

Ask yourself “Do I use this enough to justify the cost?” Small cuts, big results.

Other Quick Wins You’ll Love

Energy bills: Use a comparison site to check if you’re on the cheapest tariff.

Insurance: Don’t auto-renew – haggle or switch.

Mobile phones: If your contract’s up, keep your old phone and go SIM-only.

Hen Weekends & Wedding Costs

We love to celebrate our friend’s hen weekends and weddings – they’re joyful, but they often come with surprising costs.

What the numbers say

- For a typical hen weekend in the UK, you’re looking at about £200–£400 per person, depending on the destination and what you do.

- If the hen do is abroad, costs can climb to as much as £1,000.

- Weddings themselves cost a lot – but being a guest can also cost you: on average UK adults spend over £2,000 per year attending weddings/parties (3 events at ~£700 each) and for 25–34 -year-olds that can more than double at £4,500 per year.

So, What Can You Do About It, Without Feeling Bad?

- If you’re part of the planning, set a budget early that everyone’s okay with.

- Focus on experience, not excess: A fun group brunch, one good activity and a cosy stay can feel just as joyful without the 4‑night splurge.

- Factor these costs into your “social season” budget: If you know you’re likely to have 3‑4 big events in a year – put aside a ‘fun fund’ and stick to it!

- Remember the big picture: Every £100 you save now – means more left for your future goals.

Example: if you’re in the 25 – 34 year age bracket and put aside £500 for 4 big events a year = £2,000, that would save £2,500 on the average being spent at present.

What If You Invested Those Savings?

If you can make all the saving tweaks above, what would that amount to?

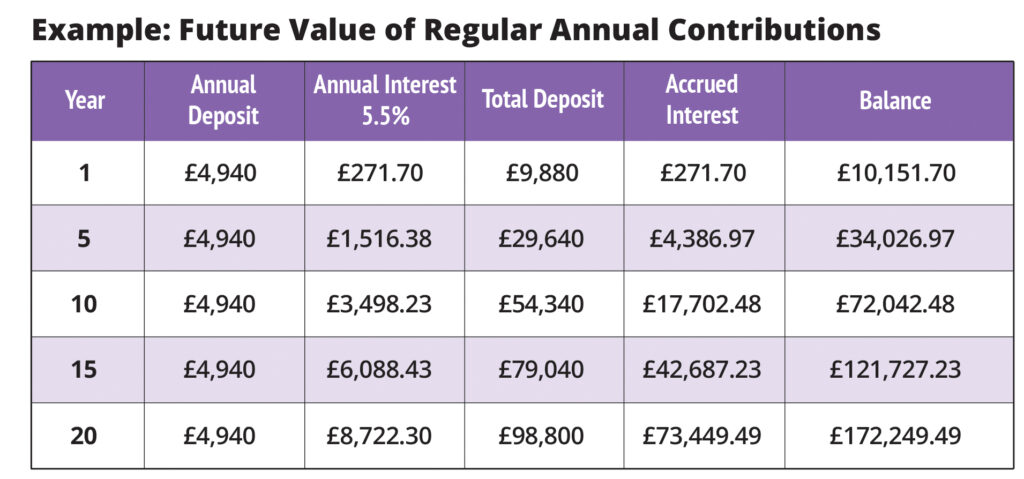

Let’s say you followed all the tips above and saved £4,940 each year – totally doable. Like Monica, 35, you pop that into a Stocks & Shares ISA and leave it for 20 years and earned an average annual return of 5.5%. Now we add a bit of maths using the “magic of compounding”:

Monica could end up with around £172,249.49 after 20 years.

Note: This is a projection. Actual returns can vary based on market performance, fees, and timing. The FCA, the industry regulator advises investing should not be viewed as a short-term solution to a problem. Investing over a timeframe of at least five years can give your investment more opportunity to ride out any short-term performance dips.

Why This Matters for Women

Too often we have conversations with women who feel money is “not for them” – that it’s some exclusive club they didn’t get invited to. But money isn’t a mystery, it’s a skill – and it’s learnable.

Think of budgeting, saving and investing not as boring chores, but as powerful acts of self-love, care and freedom. You’re not just managing money — you’re manging how your older self will live. It’s about not becoming another statistic in the gender savings, pension and poverty data but living your days the way you want to.

Final Thoughts

Whatever the Autumn Budget throws our way, there will be more budgets, more uncertainty and more worry. These quick tweaks put you back in control and can begin building your financial security and confidence.

The earlier you start building smart money habits, the bigger the impact. Time is your superpower — every pound you save in your 20s and 30s, has more time to grow, giving future-you more freedom, options, and peace of mind. You’ve got this!

How MoneyShe can help you

At MoneyShe, we’re professional investors who take the hard work out of investing, so you can get on with your life knowing your money is being looked after carefully.

We manage your wealth in a way that’s risk-appropriate, low-cost, and diversified, so you don’t have to stress over market bubbles or stock picking. You can be confident that your investments are built to last, with experts keeping an eye on risk and return — not hype and headlines.

We handle the complexity – while you carry on focusing on what matters most to you.

Here’s what we offer:

- Easy-to-understand investment guides

- Access to low cost, risk-adjusted, highly diversified portfolios

- Quarterly Webinars

- Smart Tools for risk analysis and costs

- A Matchmaker Risk Questionnaire to determine your level of risk

- A free introduction wealth management call with our friendly investment team.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.