Spring is in the air – and while you’re airing out closets, getting rid of clutter and replanting the garden, why not give your finances a fresh start too?

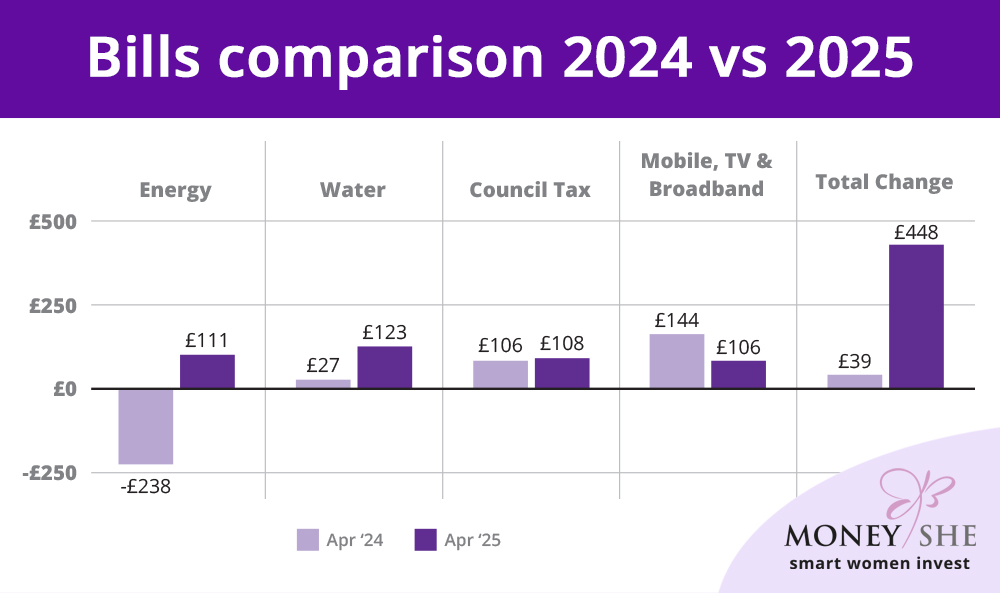

This Spring 2025, it’s more important than ever as we face a raft of bill increases that will make the cost of living even tougher for millions of us.

Just like your home, your money deserves a seasonal airing and reviewing. Whether you’re looking to streamline spending, reduce debt, or grow your savings, spring is the perfect time to clean up your financial plan and goals.

Here are some smart, manageable steps to help you spring clean your finances:

-

Review Your Budget – Update to Account for Any Life Changes

- Life changes – so should your budget.

- Take a fresh look at your income, outgoings, and saving/investment goals.

- Are you still on track?

- Are there any direct debts, subscriptions draining your account that you’ve forgotten about?

???? Tip: Use budgeting apps to help automate tracking and spot spending patterns you might miss.

-

Tidy Up Your Subscriptions and Bills

- It’s easy to lose track of what you’re paying for monthly.

- Now’s the time to cancel any unused memberships, renegotiate bills, use comparison websites for bills, insurances, and ensure you’re not being double-charged, or paying for things you no longer need.

???? Tip: Look out for “free trials” that have quietly turned into paid plans and cancel them if you’re not using the service.

-

Declutter Debt

- Make a list of all your and your family’s debts – credit cards, loans, overdrafts – and focus on repayment strategies.

???? Tip: Consider the snowball method (pay off the smallest first) or avalanche method (focus on highest interest) to build momentum and save on interest.

-

Check Your Credit Report

- Your credit score matters more than you might think – from getting a mortgage to securing a better deal on a loan.

???? Tip: Check your credit report for free at least once a year – they often have dispute errors, mistakes or old information that can hurt your credit score.

-

Refresh Your Savings Plan

- Are you saving enough for emergencies, holidays, or future goals?

- If not, tweak your financial strategy – whether it’s increasing automatic monthly top-ups, taking advantage of tax-free investment investing such as a ISA, JISA for your kids, or Self-Invested Personal pension (SIPP).

???? Tip: Aim to build an emergency cash cushion that covers 3- 6 months of your outgoings.

-

Start or Revisit Your Investment Plan

- Investing is one of the best ways to grow your wealth over time – but it often gets overlooked.

- Make any extra savings work harder by investing in stocks and shares via a diversified, low-cost, ETF portfolio.

- Remember, investing isn’t just for the wealthy! Small, regular contributions can grow significantly over time thanks to the magic of compounding.

???? Tip: If you’re starting out make sure you know ALL the fees, ALL the holdings (where your money will be invested), and for an extra sense of security ask if the person or team managing your investments, are investing alongside you as well.

If your already investing, take time to review your portfolio. Does it still align with your goals and risk tolerance?

-

Don’t Forget Retirement

- Retirement might feel like a distant concern, but the earlier you start saving, the more you benefit from compound growth.

???? Tip: Check in on your pension contributions – whether it’s a workplace scheme or a private pension. Could you increase your contributions even slightly? Don’t miss out on employer matches or government tax relief.

Use tools like pension calculators to see if you’re on track and what adjustments might help you achieve financial security and freedom.

-

Set One New Financial Goal

- Whether it’s paying off a credit card, saving for a holiday, investing in a stocks & shares ISA, or topping up your pension – pick one clear, achievable goal and commit to it.

???? Tip: Be SMART, stay on track and be motivated.

-

-

- Specific

- Measurable

- Achievable

- Relevant

- Time-lined

-

Final Thoughts on Mastering a Financial Cleanse

Spring cleaning your finances keeps you on track and save you more than you think, as well as make your money grow.

Doesn’t have to be overwhelming – grab your metaphorical mop and get your money sparkling!

Whether it’s eliminating hidden costs, strengthening your savings safety net, or taking your first (or next) step into investing – every small money move today can bring big rewards tomorrow.

If you would like to find out your investment risk tolerance, try our FREE Matchmaking Tool here . If you’re ready to invest, book your free investment call here.

The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios please contact an independent financial adviser.