31 July 2025

.In her July 15 Mansion House speech, Chancellor Rachel Reeves unveiled what’s being described as the biggest UK pension reform in decades. It included merging small local pension schemes into large “megafunds” to unlock investments in infrastructure and growth assets.

Just days later, on July 21, 2025, the UK government revived the landmark Pensions Commission (the 2006 Pension Commission was a huge success and built consensus for auto-enrolment). Additionally, it launched a statutory review of the state pension age.

The current state pension age is 66. The previous Tory government said in 2023 that an increase in the state pension age to 67 would be phased in between 2026 and 2028. A further review on raising the age to 68 would take place within two years after the 2024 election. Under 2014 legislation, Britain’s government must undertake a review every six years. The review considers demographic and economic factors affecting retirement age.</p>

As it stands the retirement age is scheduled to rise to 67 (by 2028) and 68 (around 2044–46). Further increases are under review through 2029. </strong>

So, with the state pension moving further into the future, private retirement provisions are more vital than ever.

At present:

- Nearly half of working-age adults still aren’t saving anything – putting them at risk of having poorer retirement incomes than people retiring today.</li>

- Employers currently contribute around 3% and employees 5% of salary under auto-enrolment, but experts such as The Institute for Fiscal Studies warn this isn’t sufficient for a comfortable life in retirement.</li>

Even £20 – £50 a Month Makes a Difference

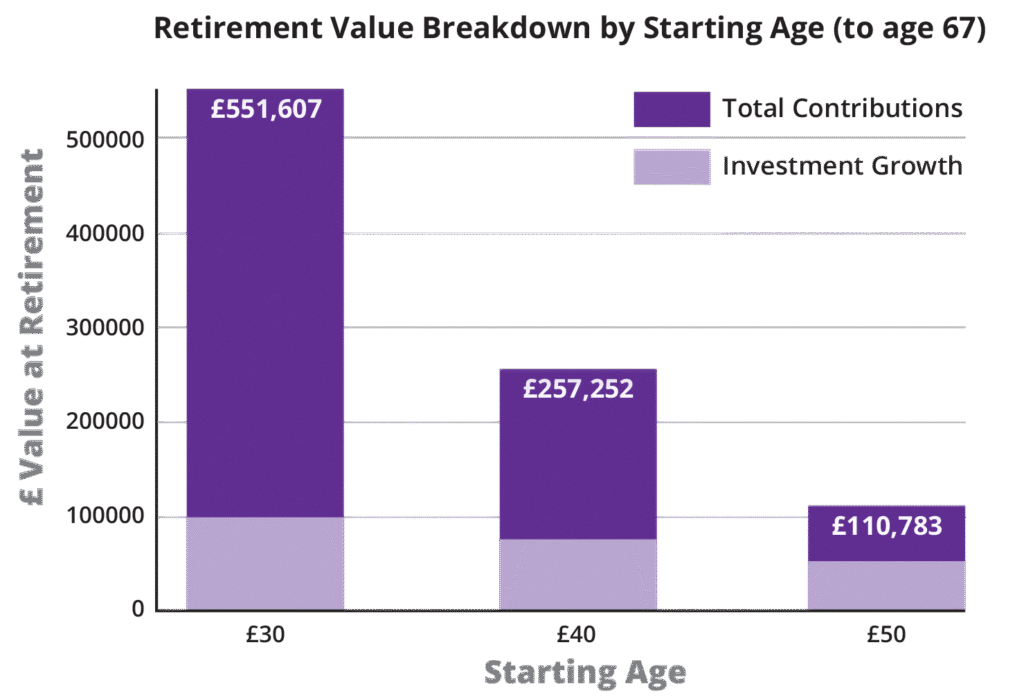

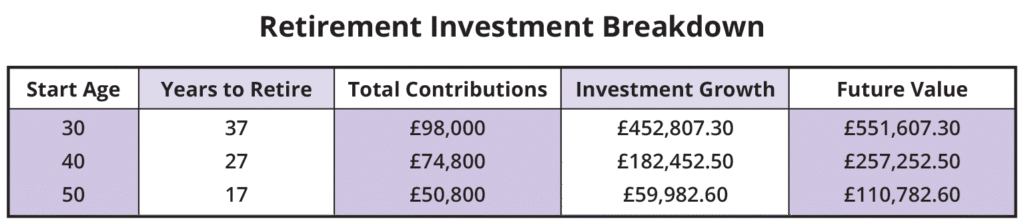

Here’s a comparison of how much you would accumulate by the retirement age of 67 if you started investing with MoneyShe at age 30, 40, or 50, assuming:</p>

- Initial investment: £10,000

- Monthly contributions: £200

- Annual return: 7% (compounded monthly)

- Retirement age: 67

Retirement Pot – With The Magic of Compounding

- Starting at 30 gives you over £500,000 at retirement.

- Waiting until 40 cuts your total by almost half.

- Waiting until 50 gives you less than a third of what you’d have starting at 30.

If you’re not yet eligible for MoneyShe, here’s a plan you can start right now:

- Start Small

Saving an extra £20 – £50 a month may not seem much, but even with modest investment returns, it adds up and you can then invest for higher returns with experts like MoneyShe once you have the minimum amount.</li> - Track Your National Insurance Contributions

You’ll need 35 qualifying years to claim the full new state pension (about £221/week). So, it’s important to check any gaps/shortfalls with HMRC. Any shortfalls can be addressed through voluntary NI contributions before these build up and become unaffordable.</li> - Maximise Workplace Pension Contributions

If you can, top up your contributions or enrol in additional private/personal pensions—early contributions benefit most from compounding returns.</li> - Look at all Your Options

With more responsibility now being placed on individuals, options such as self-invested personal pensions (SIPPs), ISAs, 9for children JISAs) and deferred state pensions offer more options, flexibility and growth opportunities.</li>

How MoneyShe Can Support You

- Low-entry access: As soon as you can invest the minimum of £10,000, the MoneyShe experts are dedicated to transforming your contributions into low cost, highly diversified, lower risk, screened portfolios that match your financial goals.</li>

- Support and education: Learn with digestible articles, tipsheets, quizzes and webinars, and calls on topics like compounding, ethical investing, and pension options.</li>

- Top-up tools: Once eligible, our easy-to-use investment platform allows you to open an account in less than 10 minutes, automates monthly contributions and gives you 100% transparency on all your costs and holdings – designed to give you peace of mind and long-term growth.</li>

- Women-first approach: We understand the reasons for the gender investment and pension gaps – rooted in lower earnings, career breaks, and part-time work, lack of confidence and time. So, we always design our communication and tools with you in mind.

Final Takeaways

- Pension reforms are happening NOW! Pension reviews, and future rises to the state pension age, more unstable work and economic environments.

- Now is the time to build good habits. Even modest monthly savings can compound into significant long-term gains.

- MoneyShe is here to support you when you’re ready. Through education, planning, and investment strategies designed for women’s long-term goals.</li>

Are you a saver without enough to join MoneyShe yet? Commit to saving at least £20 – £50 per month to build the foundation for your future retirement.</p>

Every journey starts with small, consistent steps.

And when you’re set to take the next leap, MoneyShe is here to help turn your savings into a sustainable financial future.</p>

If you would like to find out your investment risk tolerance, try our FREE Matchmaking Tool here . If you’re ready to invest, book your free investment call here.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.