20th August 2025

Diversification – investing across different sectors, assets, regions, and styles – isn’t investment jargon. It’s the foundation of smart investing.

By spreading your money thoughtfully, you benefit form a smoothing effect where you’re less exposed when one investment falls and better positioned when others shine. It’s a strategy that’s stood the test of time, and it needs to be in every woman’s investment toolkit.

What Does Diversification Mean for Your Portfolio?

In plain terms: don’t put all your eggs in one basket.

A diversified portfolio ensures that no one holding can sink your investment plans, while stronger performers not only keep your portfolio afloat but racing ahead. Nobel Laureate Harry Markowitz famously called diversification the “only free lunch” in investing, referring to its ability to lower risk without sacrificing expected returns.

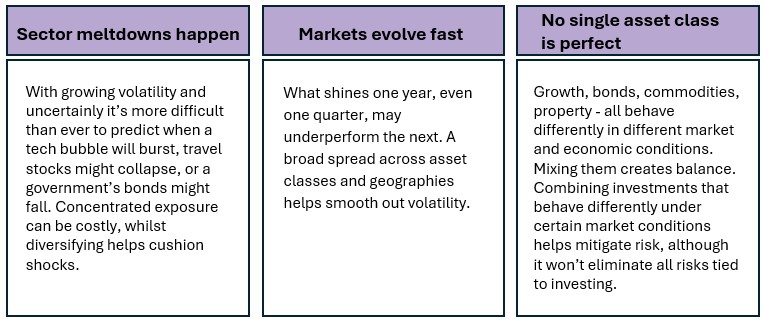

Why It Matters—Especially Today

Diversification is Getting Harder

Investors have traditionally looked to historical relationships, correlations, between different asset classes as a guide for creating a diversified portfolio.

Achieving diversification is getting harder as long-held correlations between asset classes once thought of as established no longer consistently hold true. For example, the price of debt issued by companies, known as bonds, are no longer moving as reliably in the opposite direction to share prices.

Investors cannot simply construct a traditional portfolio of 60 per cent shares and 40 per cent bonds and expect that the bond component will offer protection should equity markets crash.

Smart investors are using ETFs to efficiently access companies, countries and regions, and across multiple asset classes – including alternative assets, such as gold, to achieve a level of portfolio diversification that has the potential to spread risk more effectively.

How Many Stocks Are Enough?

There’s no magic number, but research over decades provides valuable guidance. Historically, owning 30 – 40 carefully selected stocks was considered sufficient to mitigate unsystematic risk. But this has changed with increased global volatility and interconnected markets.

The Rise of ETFs and Enhanced Diversification

The evolution of exchange-traded funds (ETFs) has significantly transformed how investors build diversified portfolios. Investors can now achieve broad exposure through a handful of ETFs, simplifying portfolio management while maintaining enhanced diversification.

Exchange Traded Funds (ETFs)

ETFs are a collection of shares which are pooled together into one basket. They can track a stock market index, such as the FTSE 100, and are an easy, inexpensive way to gain access to a varied range of large brands in the UK or overseas in one ‘share’.

Buying a FTSE 100 ETF, for example, will give you exposure to the biggest 100 companies listed on the UK’s stock market. This will help to achieve portfolio diversification and spread some of the risk in a single trade.

There are different types of ETFs, with the market growing considerably. Even amongst those that track the same index, so investors need to understand what those are, as well as consider the suitability of an ETF against your individual needs and risk tolerance.

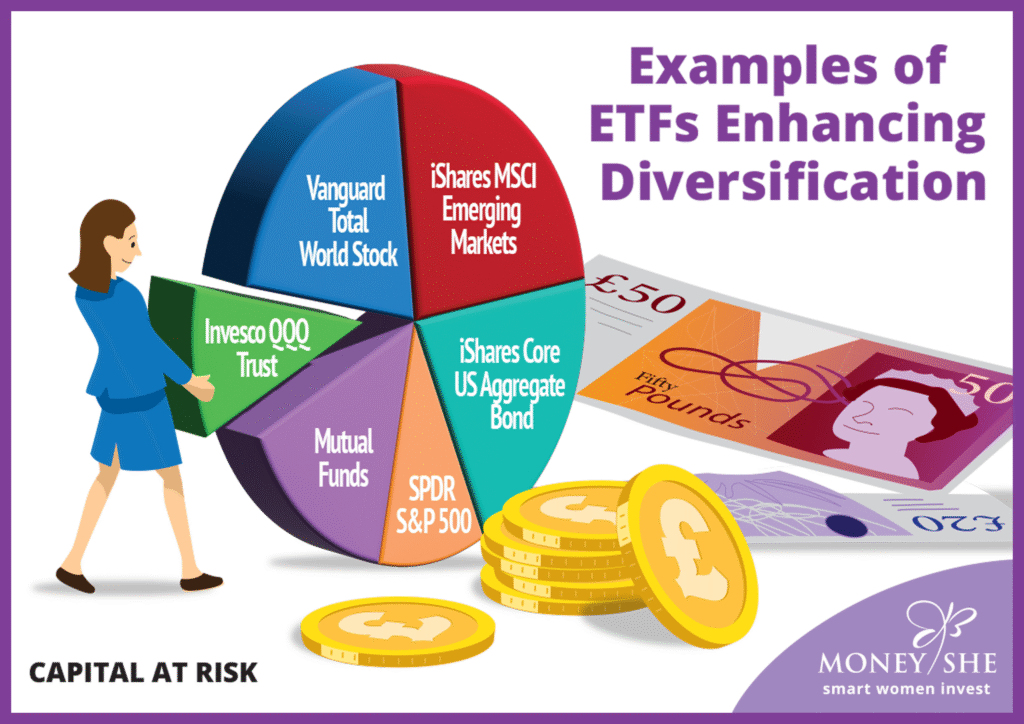

Examples of ETFs Enhancing Diversification:

- SPDR S&P 500 ETF Trust (SPY): Covers 500 major U.S. companies across sectors like technology, healthcare, finance, and consumer goods.

- Vanguard Total World Stock ETF (VT): Blends U.S. and international equities for global market exposure.

- iShares MSCI Emerging Markets ETF (EEM): Targets developing markets such as China, India, and Brazil, broadening geographic reach.

- Invesco QQQ Trust (QQQ): Focuses on the Nasdaq-100 index, offering concentrated exposure to tech innovators like Apple, Microsoft, and Nvidia.

- iShares Core U.S. Aggregate Bond ETF (AGG): Diversifies across asset classes by adding a bond component, smoothing risk and return.

Benefits You Can Count On

- Smoother ride: One asset drops? Others help cushion the blow. A diversified portfolio tends to be steadier and lower volatility.

- Reduced emotional panic: You’re less likely to sell at the worst moment when your portfolio isn’t all in one place. Fewer highs and lows make it easier to stay invested through market swings.

- Better risk-adjusted long-term returns: Studies show diversified portfolios often outperform concentrated bets over 10+ years, especially as investors are not chasing single big winners. Your overall portfolio becomes more efficient.

Diversification Mistakes to Avoid

❌ Over-diversifying

Holding too many funds or ETFs with overlapping holdings (e.g. several UK equity funds) can dilute your returns.

❌ Chasing trends

Jumping from fund to fund based on what’s hot today usually leads to disappointment tomorrow.

🟣DIY Tip: Pick a mix you can stick with and check in quarterly – not daily!

MoneyShe: Example Portfolios Built with ETFs

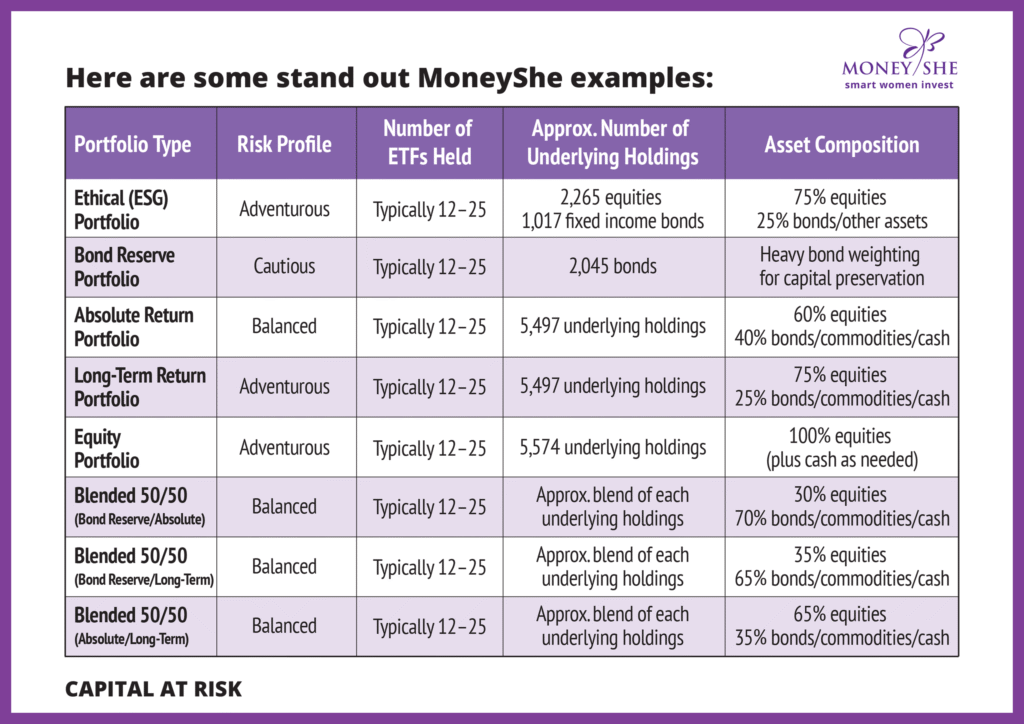

MoneyShe offers discretionary, actively managed portfolios constructed entirely with ETFs. This allows investors to benefit from both strategic asset allocation and the cost-efficiency of passive instruments.

Portfolios typically include 12 – 25 ETFs, enabling diversified exposure across equities, bonds, and regions – all within one managed vehicle.

Here are some standout MoneyShe examples:

These MoneyShe ETF Portfolios provide clients with well-balanced portfolios, designed and adjusted professionally within agreed risk parameters – while maintaining transparency, efficiency and low fees.

Final Thoughts ✨

Diversification may not sound glamorous, but it’s powerful. It’s about preserving your capital while still giving yourself a chance to grow it. Think of it as setting a stable foundation so you’re not knocked off course by any one event.

A diversification investment strategy is like your financial seatbelt. It protects you when markets wobble and helps keep your investment journey steady and sustainable. And the best part? You don’t have to do it all yourself. Low-cost ETFs managed by a professional investor such as MoneyShe can do the hard work for you.

So, whether you’re investing for your first home, your kids’ future, or a confident retirement—make diversification your superpower.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.