14 August 2025

When we think about our future selves, we often imagine exciting things – travel, freedom, our own little business, volunteering, maybe a beachside retirement, or helping with grandchildren.

But let’s talk about what will make these dreams possible – money!

It might not be sexy, but pensions and investments are powerful. And right now, pension in particular is facing big changes in the UK that every young woman should not just know about, but be acting on.

The Pension Picture Is Changing Fast

The UK government is considering raising the state pension age to 68 sooner than planned – potentially as early as 2039 instead of 2044. Experts warn that those aged 51 – 53 could lose around £18,000, meaning millions of people could miss out on up to £18,000 in state pension payments. Women in their early 50s are expected to be hit the hardest, but the long-term implications affect us all.

With public spending pressures mounting and the UK population aging, the message is clear: you can no longer rely on the state pension alone. The sooner you start saving for your retirement, the more control we’ll have over our financial future.

Why Young Women Should Care

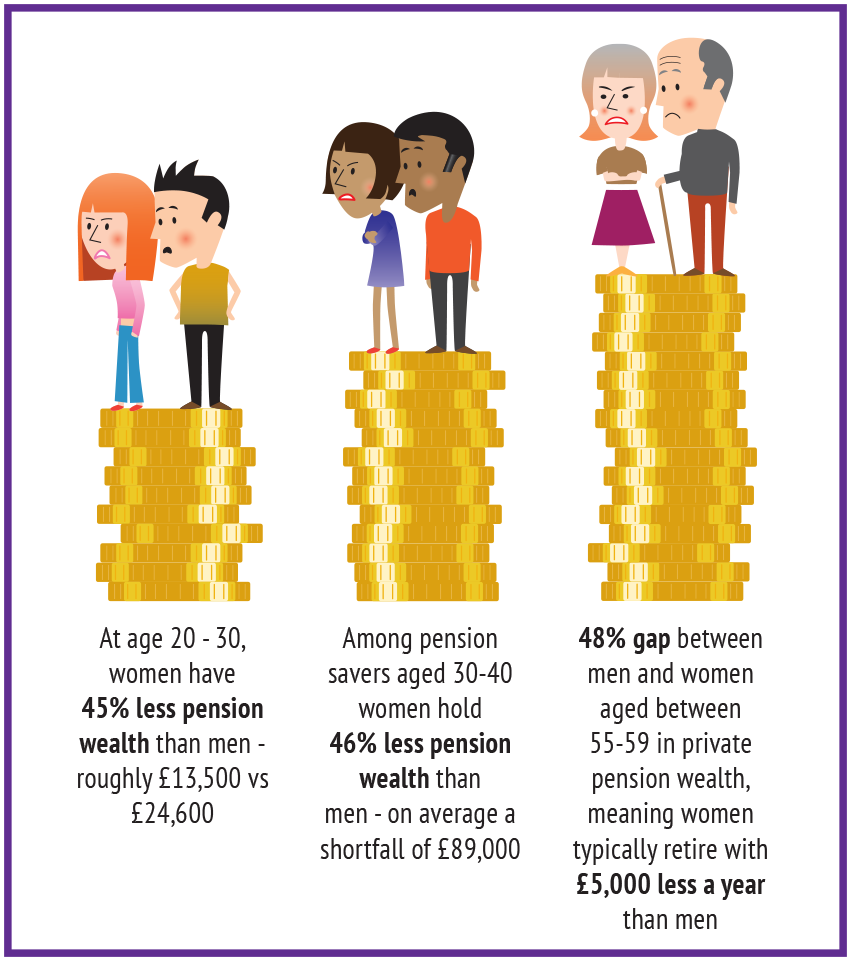

Even without the reforms, women in the UK already retire with far smaller pension pots than men. Combine that with policy shifts, and the stakes become even higher. Let’s look at some numbers:

Gender Pension & Investment Gaps in the UK

Wealth Gap

- The gender wealth gap opens as early as age 19, and by age 64, women’s total wealth is £101,000 less than men’s.

- The shift from defined benefit (DB) to defined contribution (DC) pension schemes has widened the gap – women fare worse under DC, particularly outside of public sector roles.

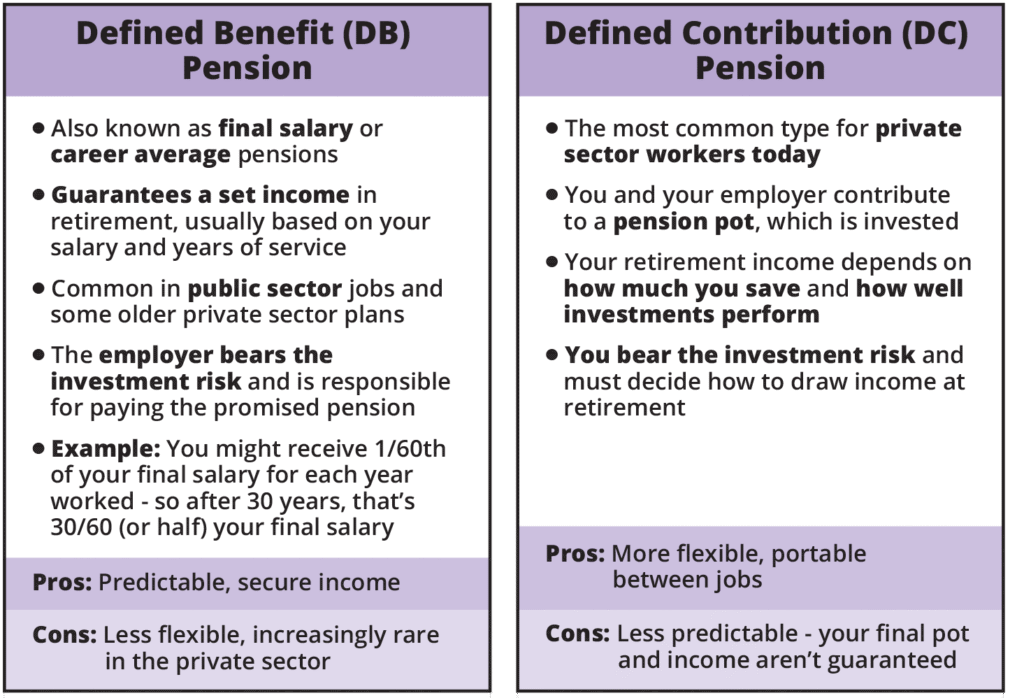

Types of Pensions

Defined Benefit (DB) vs. Defined Contribution (DC) Pension Schemes Explained vs. a Self Invested Personal Pension (SIPP)

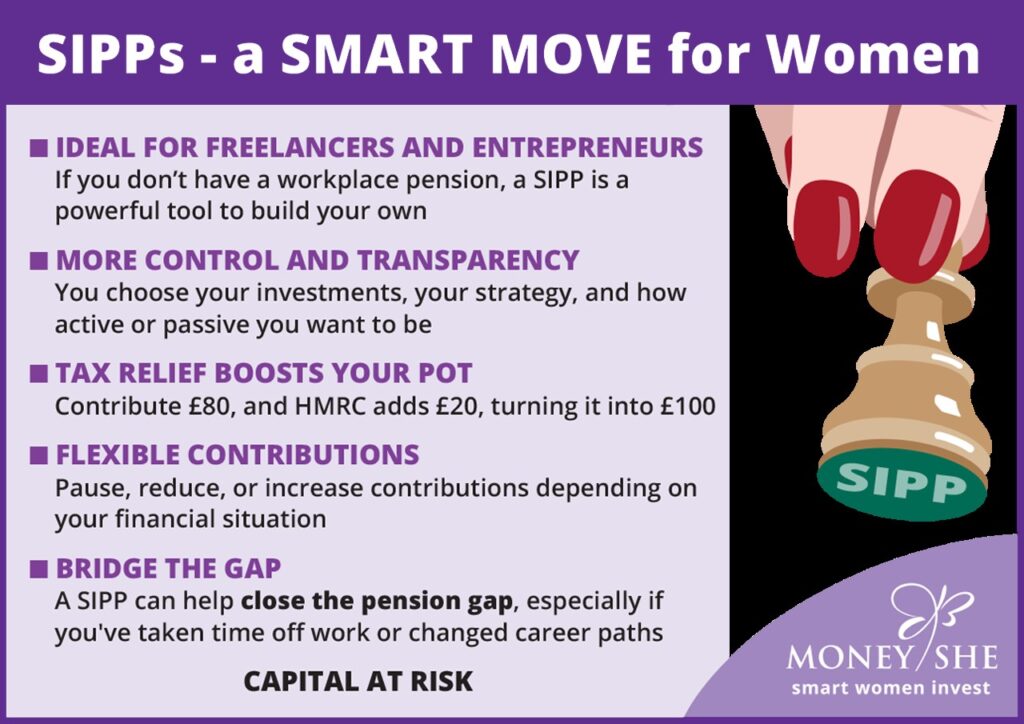

Could a SIPP Be Right for You?

If you’re self-employed, freelance, or simply want more control over your retirement savings, a Self-Invested Personal Pension (SIPP) could be a great option.

What is a SIPP?

A SIPP is a type of Defined Contribution (DC) pension that gives you more freedom to choose and manage your own investments – stocks, funds. ETFs and even commercial property can be held in a SIPP.

A SIPP works like a regular pension: you make contributions, get tax relief (typically 20% or more, depending on your tax band), and your investments grow tax-free. But unlike workplace pensions, you’re in charge of where the money goes.

Tip: You can combine a workplace pension with a SIPP for maximum tax efficiency and control. Even contributing small amounts consistently to a SIPP can build long-term wealth – especially if you start in your 20s or 30s.

SIPPs aren’t just for the wealthy or the finance-savvy — they’re a powerful tool any woman can use to take charge of her financial future.

Why It Matters for Women

- DC pensions often disadvantage women due to lower earnings, part-time work, and career breaks, which lead to smaller contributions.

- DB schemes, while more generous, are now rare outside of the public sector – especially affecting younger generations of women.

Understanding the type of pension you have helps you plan better for the future – and make choices that can help close the gender pension gap.

Investment Gap

- The UK’s Gender Investment Gap is now estimated at £567 billion, because fewer women investing compared with men.

- Only about 33 – 40% of investors in the UK are women, with many never seeing themselves as investors.

Why These Gaps Exist

- Women are more likely to work part‑time or take career breaks for caregiving – reducing earnings, savings and contributions to pensions.

- Women earn less on average than men, compounding the savings gap over time.

- Auto‑enrolment rules exclude earning below £10,000 per employer, which disproportionately affects female part‑time workers. (MoneyShe is calling on the government to reduce this amount and pay credits to pensions for women who take a break to care for a child or relative – see here

- Cultural and confidence barriers mean many women delay investing or stick with low‑risk cash savings rather than market investments, forgetting that saving in cash carries the risk of not beating inflation do not delivering real returns.

Why This Matters for Young Women

Let’s be real – despite years of older women fighting to close the gender pay, pension and investment gaps, they remain significant.

Add to that your plans for any career breaks, children, part-time work, resulting in lower average earnings, young women will still face a steeper climb toward financial security in retirement. One that is likely to be even steeper due to shifts in global financial stability and predictability, as well as government’s reforms – making it even more urgent for young women to take their future into their own hands.

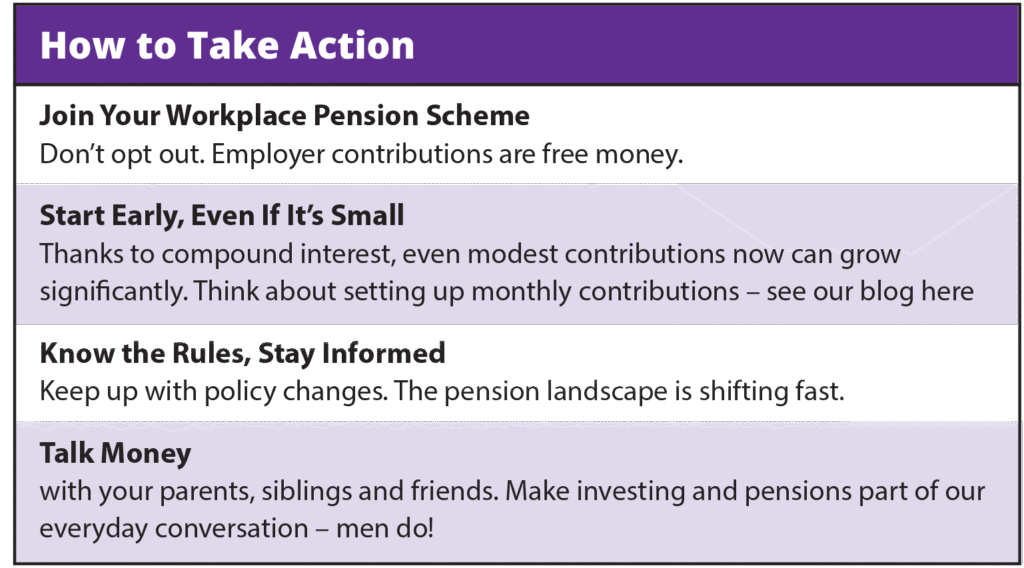

How to Act

Your Future is at Stake

This isn’t about fear – it’s about empowerment.

Estimates show that raising the pension age by one year saves the government £6 billion annually. While this might make economic sense, it means the burden of saving shifts to individuals – especially women who are already financially disadvantaged in retirement.

If state support becomes less generous, private and workplace pensions become even more critical. Starting now gives you more time, more flexibility, and more freedom later.

The Labour government pension reforms on the table are a wake-up call. The earlier you start saving, the less you’ll have to worry about the political realities and changes coming down the track – whoever is in government as you grow older.

Take control. Future you will be grateful – and have much more financially freedom and choices.

Start now. Invest in yourself. Build the financial resilience to thrive, on your terms.

🟣 Join the MoneyShe community today and take the first step toward reclaiming your financial future.

👉 Explore our tools and start investing now

Important Notice:

This is general information only and not financial advice. The value of investments can go down as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. None of the trading brands of SCM Private, MoneyShe or SCM Direct – give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.